IRS Properly Issue FPAA to Partnership Holding Interest in Partnership That Had Previously Received an FPAA

The taxpayer in the case of American Milling, LP v. Commissioner, TC Memo 2015-192 argued that the Tax Court lacked jurisdiction to hear the case where the IRS would ultimately push a tax assessment down to a real taxpayer.

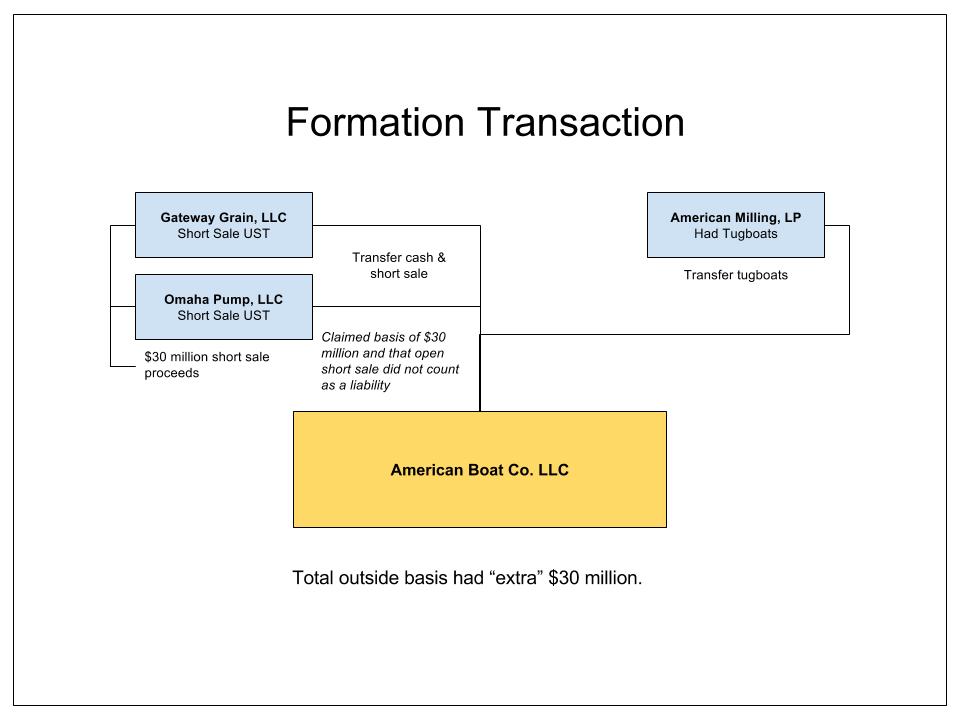

The taxpayer in question had taken part in Son of Boss style tax shelter. That shelter can be outlined as follows:

Following setting up that structure and closing the short sale (which would generate a minimal gain/loss), the interests in the two single member LLCs that had taken part in the short sale of U.S. Treasury notes were transferred to American Milling, L.P. Since American Milling, LP now held 100% of the interests in American Boat Co., LLC the entity ceased to be a federal tax partnership.

American Milling, LP took the position that it had an outside basis in its interest that was $30 million more than the basis of the tugboats it had contributed (and which now were the only assets it was deemed to get back). Following the deemed liquidation of the partnership, American Milling, LP’s basis in the partnership would then be fully allocable to the tugboats, thus effectively boosting their basis by $30 million.

Unfortunately for the taxpayer in this case, the courts have not been kind to these structures. The IRS challenged the arrangement, and issued a final administrative partnership adjustment (FPAA) to American Boat. The IRS contended that American Boat was a sham partnership, the transaction lacked economic substance and the short sale obligations were liabilities under IRC §752 for the partnership.

American Milling, as tax matters partner of American Boat challenged the case in U.S. District Court. The District Court found for the IRS that the short sale obligations were liabilities for purposes of §752 (which effectively removed the $30 million basis inflation “magic” claimed) and that the short sale transaction followed by a contribution to a partnership lacked economic substance. [Am. Boat Co., LLC v. United States, No. 3:06-CV-00788-GPM-CJP (S.D. Ill. Nov. 20, 2008), aff'd , 583 F.3d 471 (7th Cir. 2009)].

The IRS did not directly assess tax against Mr. Jump, who was the taxpayer at the base of these transactions. Rather in 2013 the IRS issued an FPAA to American Milling, LP (the entity with the tugboats) that provided, as described by the Court:

It states that as a result of the partnership item determinations made in the American Boat FPAA and the District Court case "all contributions, distributions, and any other transactions that American Milling * * * purportedly engaged in with American Boat * * * are disregarded for federal income tax purposes. The results of the [American Boat] partnership item determinations include but are not limited to reducing the basis of assets distributed to American Milling * * * by American Boat * * * by $31,255,986". The explanation of items further states that the Milling FPAA adjusts American Milling's claimed depreciation deductions and capital loss by reducing the bases of the tugboats by $31,255,986. Finally, the explanation of items states that American Milling's deduction of $300,000 for legal fees is disallowed because American Milling "has not established that such expenses were incurred or, if incurred, allowable under any provision of the * * * [Code]".

The taxpayer object to this FPAA on two counts. First, the taxpayer claimed the FPAA issued to American Milling, LP is a duplicate FPAA in violation of IRC §6223(f). Second, the taxpayer argued that all of the adjustments in the Milling FPAA are computational adjustments flowing from the American Boat FPAA and there are no affected items requiring factual determinations at the American Milling level, and the IRS did not have authority to issue the Milling FPAA because neither the Code nor the regulations authorize the issuance of an affected items FPAA.

For the first item, IRC §6223(f) provides:

(f) Only one notice of final partnership administrative adjustment

If the Secretary mails a notice of final partnership administrative adjustment for a partnership taxable year with respect to a partner, the Secretary may not mail another such notice to such partner with respect to the same taxable year of the same partnership in the absence of a showing of fraud, malfeasance, or misrepresentation of a material fact.

The taxpayer argued the Tax Court’s holding in the case of Wise Guys Holdings, LLC v. Commissioner, 140 T.C. 193 (2013) stated that issuing a second FPAA containing adjustments that similar in content dealing with the same issues required the Court to disregard the second FPAA.

However, the Tax Court did not agree. It held:

We invalidated the second FPAA in Wise Guys because it was issued to the same partnership for the same taxable year and there was no showing of fraud, malfeasance, or misrepresentation of fact. The similarity of the content of the two FPAAs was not essential to our holding in Wise Guys . Instead, it simply aided our finding that the second FPAA was "more [likely] the result of a mistake or a lack of communication on the part of * * * [respondent] than of fraud, malfeasance, or a misrepresentation of a material fact." Wise Guys Holdings, LLC v. Commissioner , 140 T.C. at 199-200. Here, by contrast, respondent issued the Milling FPAA to the TMP of American Milling--not to the TMP of American Boat--for years distinct from those at issue in the American Boat FPAA. Wise Guys is distinguishable because it involved a second FPAA issued to the same taxpayer for the same tax year.

The Court also noted the original District Court case dealt with very different, even if somewhat related, issues, noting

Under section 6226(f), the District Court's jurisdiction in American Boat extended only to "all partnership items of * * * [American Boat] for the partnership taxable year to which * * * [the American Boat FPAA] relates, the proper allocation of such items among the partners, and the applicability of any penalty * * * which relates to an adjustment to a partnership item". The District Court did not have jurisdiction to determine the partnership items of American Milling that respondent adjusted in the Milling FPAA, which are adjustments for a different entity and for tax years different from those at issue in American Boat . Moreover, even if the District Court had made affirmative findings regarding American Milling's outside basis in American Boat or American Boat's inside bases in the tugboats for 1998,16 those determinations would not be conclusive regarding American Milling's bases in the tugboats for 2000 through 2003. See infra p. 21. Accordingly, we reject petitioner's contentions that the Milling FPAA [*18] is an improper second FPAA or that it is a duplicate of the American Boat FPAA and therefore invalid under section 6223(f).

The Tax Court also did not agree that the adjustments being made to American Milling in the FPAA were “merely computation adjustments” not subject an FPAA. The Court first notes:

Petitioner contends that respondent's description of the adjustments in the Milling FPAA makes clear that the adjustments are merely computational because respondent expressly states that the adjustments to basis, depreciation, and loss are the result of the basis adjustments in the American Boat FPAA. However, respondent's description of the adjustments in the Milling FPAA simply notifies American Milling of the reason for the adjustments. It does not preclude the need [*20] for factual determinations to determine American Milling's correct bases in the tugboats and related depreciation deductions and capital loss amount.

The Court noted that more than merely a simple computational adjustment was needed, noting:

The usual rule is that an asset distributed by a partnership to one of its partners has a basis equal to the partnership's basis in that asset. Sec. 732(a). But, under section 732(b), the basis of property (other than money) distributed by a partnership to a partner in liquidation of the partner's interest equals the partner's adjusted basis in the partnership, reduced by any money distributed in the same transaction. Accordingly, when American Boat liquidated, American Milling's bases in the tugboats under section 732(b) were determined by reference to its outside basis in American Boat.

The District Court did not determine American Milling's outside basis in American Boat as of December 31, 1998, the taxable year at issue in the American Boat proceeding. Moreover, even if the District Court had asserted jurisdiction to determine American Milling's outside basis, such a determination would not conclusively determine American Milling's bases in the tugboats for 2000 through 2003. Indeed, determining the legitimate bases of the tugboats and the resulting depreciation deductions and capital losses requires us to make specific factual findings at the American Milling level. For example, American Milling could have incurred capital improvement costs following the liquidating distribution that increased its bases in the tugboats. Determining that American Milling did not incur such costs is also a partnership-level determination. See, e.g. , Greenwald v. Commissioner , 142 T.C. 308, 315 (2014); see also Domulewicz v. Commissioner , 129 T.C. 11, 20 (2007) ("Neither the Code nor the regulations thereunder require that partner-level determinations actually result in a substantive change to a [*22] determination made at the partnership level."), aff'd in part, remanded in part sub nom. Desmet v. Commissioner , 581 F.3d 297 (6th Cir. 2009).