IRS Announces Depreciation and Lease Inclusion Amounts on Vehicles for 2016

In Revenue Procedure 2016-23 the IRS released the limits on depreciation for vehicles subject to the limitations of §280F(d)(7)(B)(i) for items placed in service in 2016, as well as the revised limits for 2014 for autos qualifying for bonus depreciation under IRC §168(k). The latter revisions were needed since Congress retroactively extended the bonus depreciation in the Protecting Americans from Tax Hikes Act, signed into law on December 18, 2015.

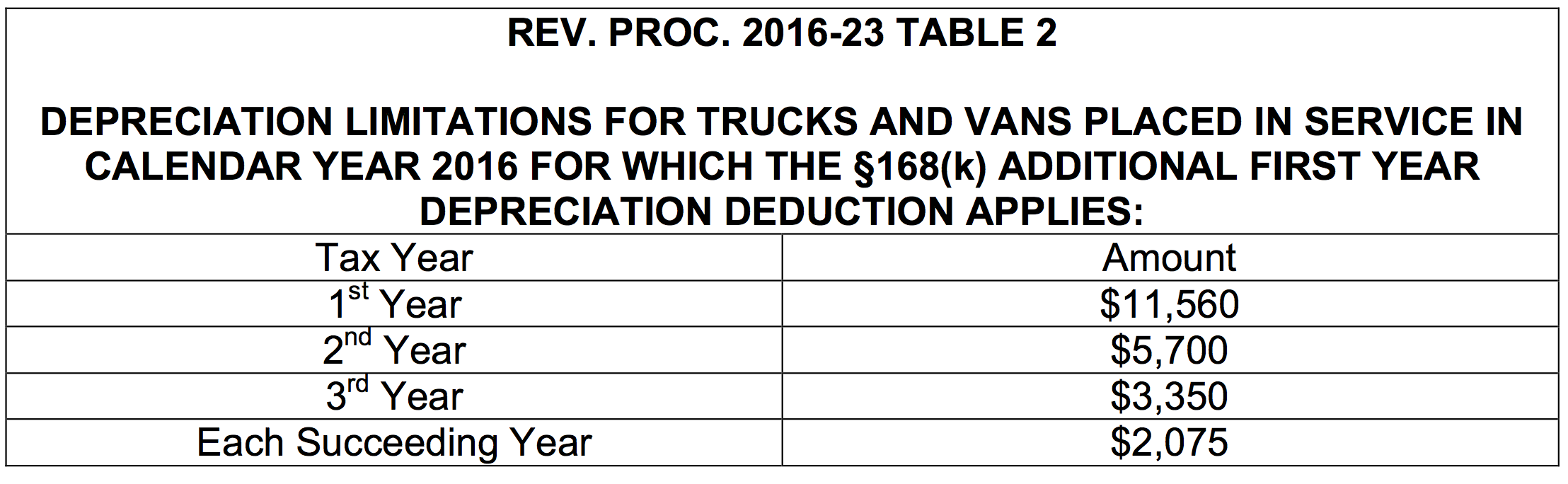

The 2016 limits are as follows:

The revised limits for vehicles placed in service before December 31, 2015 that are eligible for bonus depreciation are:

The procedure also contains updated tables to be used for the lease inclusion amount under Reg. §1.280F for lease terms beginning in calendar year 2016, as well as modifying the lease inclusion amount tables for 2015 previously published in Revenue Procedure 2015-19 by striking the first line lease inclusion amount in each of those tables. The 2015 lease inclusion tables now apply to passenger automobiles that are first leased by the taxpayer in calendar year 2015 with a fair market value over $19,000, andto trucks and vans that are first leased by the taxpayer in calendar year 2015 with a fair market value over $19,500.