Drafts of 2019 Forms 1065 and 1120S, As Well As K-1s, Issued by IRS

The IRS has released new and/or update draft Forms 1065, 1120S, and the related K-1s for 2019. The new form contains certain changes for 2019 returns.

Some of the more significant revisions are:

Required use of tax basis capital for the capital account reconciliation on Schedule K-1 for partnerships;

Disclosure of additional information related to §704(c) transactions on the partnership Schedule K-1;

Guaranteed payments will have to be split on the partnership K-1 between those for capital and those for services;

Additional information on the existence of activities for at-risk and passive activity purposes on all forms; and

Switch to the descriptive text disclosures for §199A information that was first revealed on the July draft of the Form 1120S Schedule K-1.

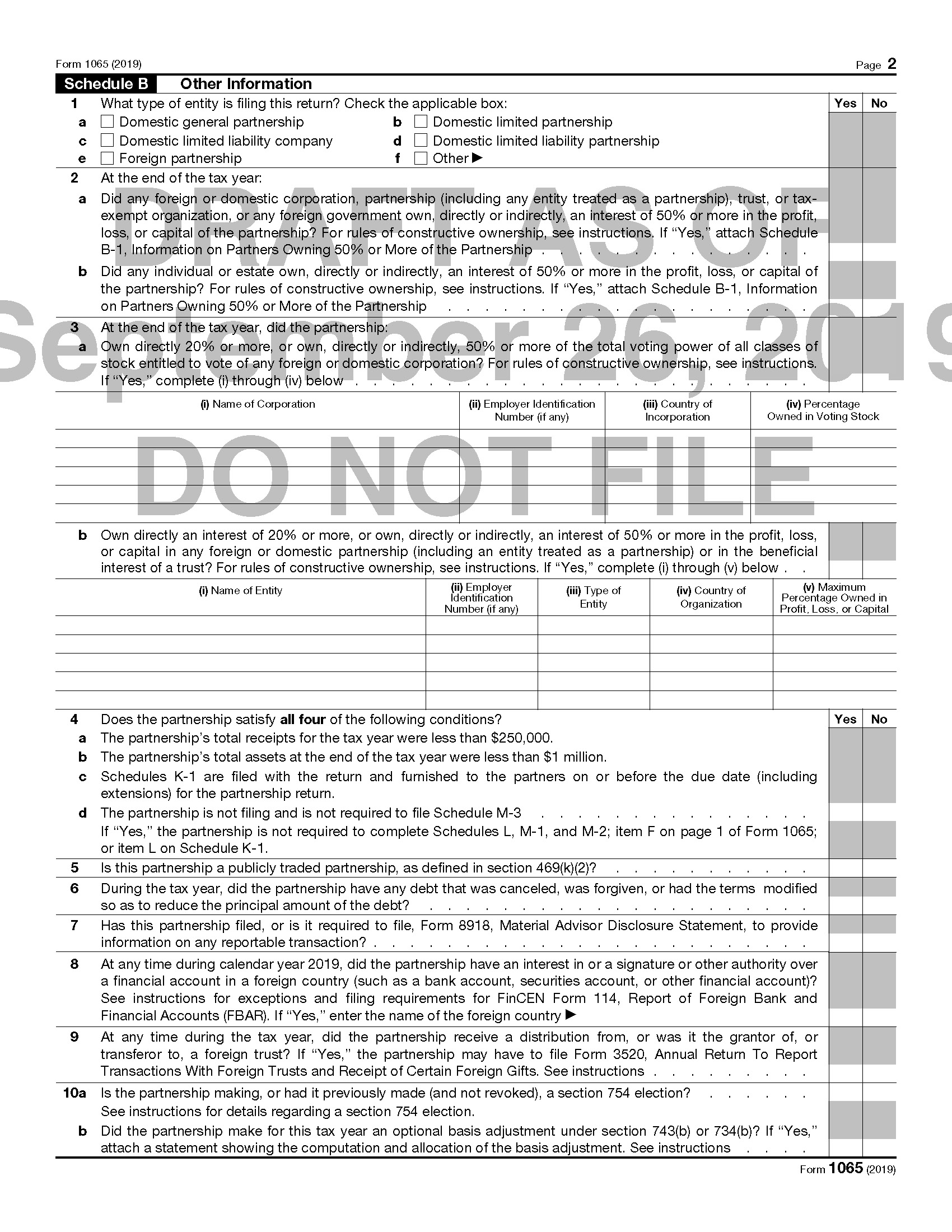

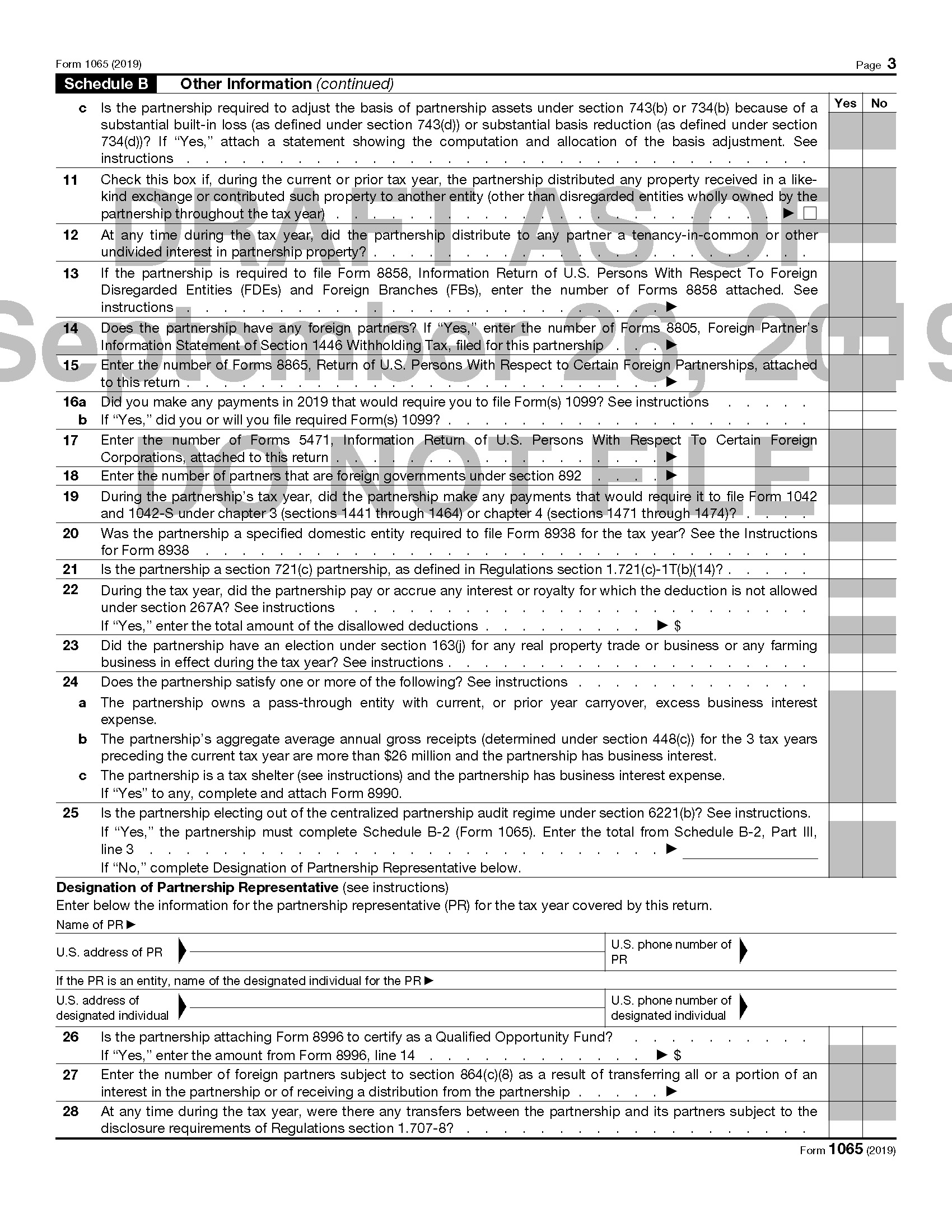

Here are the pages from the Form 1065 for 2019:

A new piece of information is required at the top of Form 1065, asking if the partnership has aggregated activities for §465 at-risk purposes or has grouped activities for §469 passive activity purposes.

The last two questions are new for 2019.

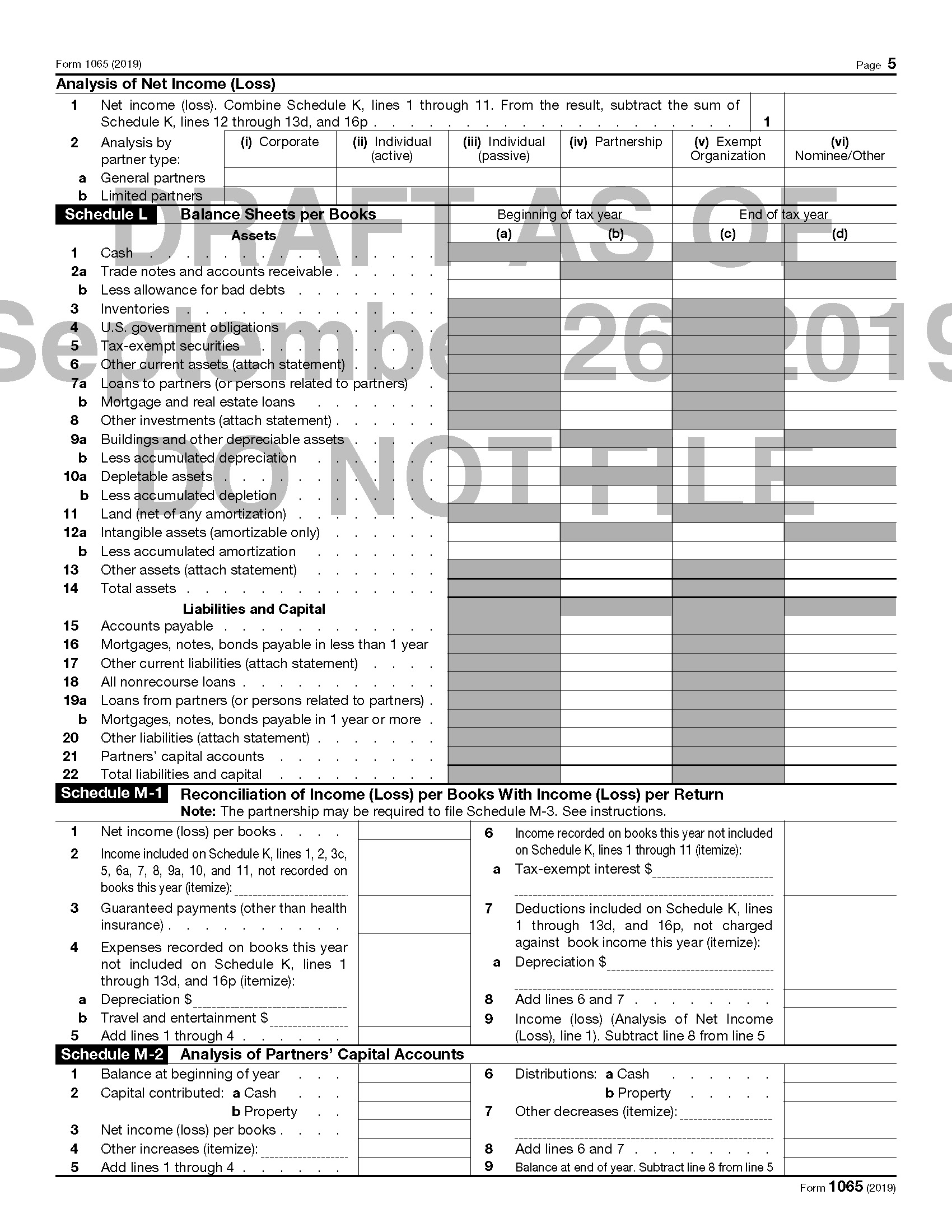

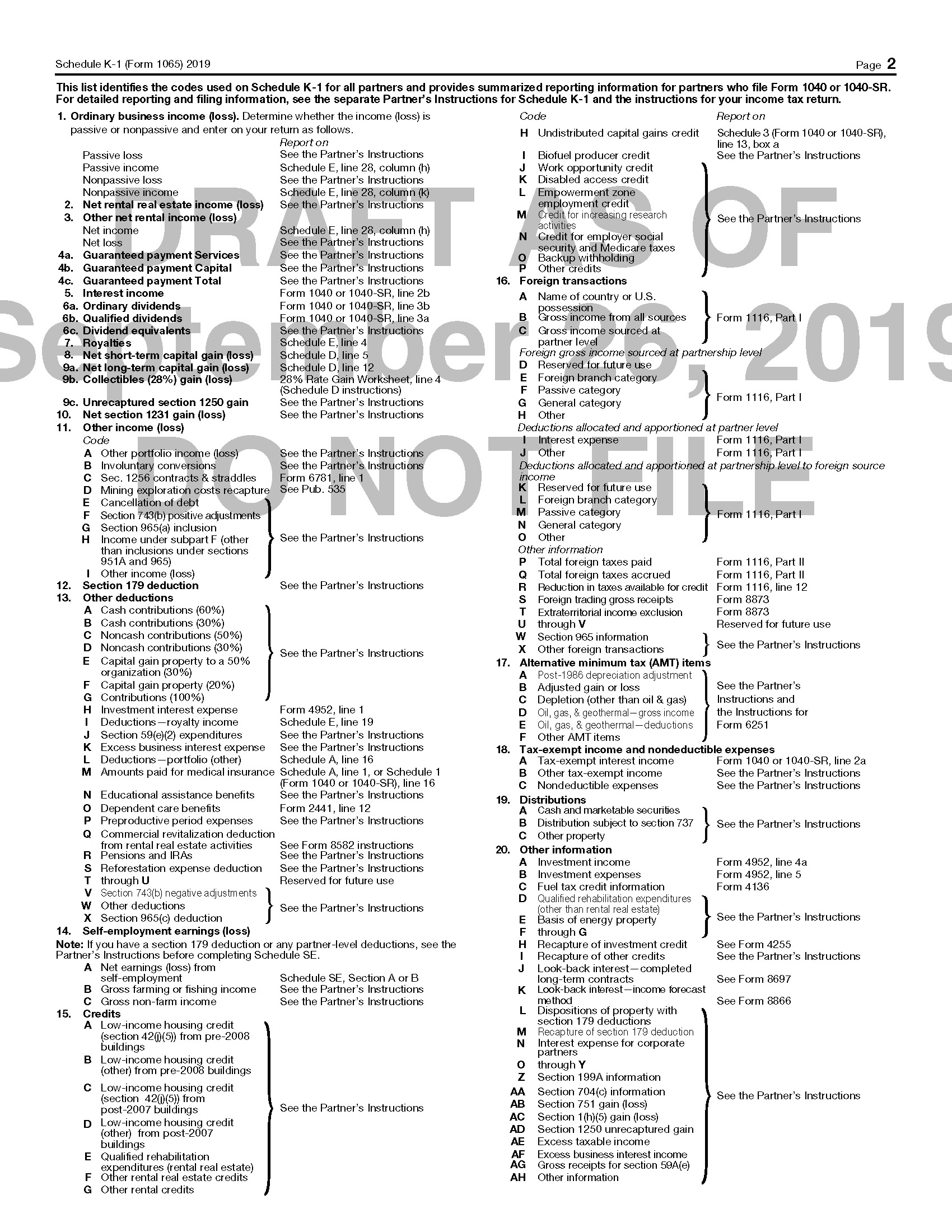

Here is the draft K-1 for the Form 1065 for 2019. This form has more noticeable changes.

The new K-1 eliminates the options for the basis under which partners capital accounts will be reported, only allowing the tax basis reporting. The form also adds details for §704(c) gain/loss and adds questions asking if there is more than one activity for at-risk purposes as well as for passive activity purposes.

As well, it separately asks for information on two types of guaranteed payments, asking for information on such payments for service and for capital, along with the total guaranteed payments.

And, finally, it asks the partnership to disclose if there is more than one activity for at-risk and passive activity purposes and, if so, directs the partner to additional information the partnership will supply—though, until the instructions are released, we can’t know for sure what exactly the IRS will expect the partnership to disclose to the partner.

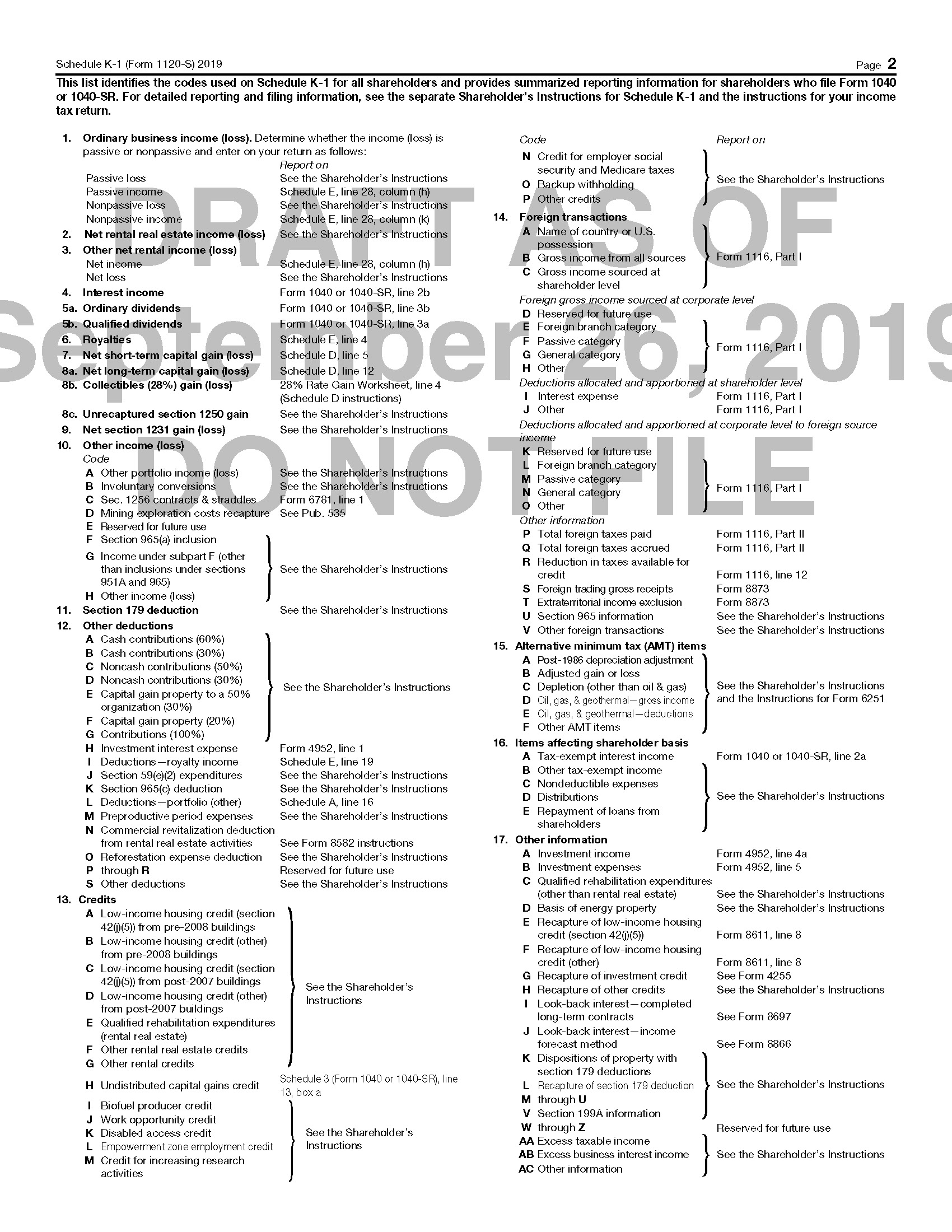

The IRS had previously issued a draft Form 1120S Schedule K-1 that had been discussed on the Current Federal Tax Developments site.[1] The IRS has now updated that K-1 and released the draft of the Form 1120S as well.

As with the draft Form 1065, a new line is added at the top of the form to indicate if the S corporation has aggregated activities for §465 at-risk purposes or grouped activities for §469 passive activity purposes.

The second revision of the Draft Schedule Form 1120S K-1 is also released. As with the original July 25, 2019 draft, this Schedule K-1 include the one-line reference to §199A information.

At the bottom right side of the K-1, the S corporation must disclose if it has more than one activity for at-risk purposes and more than one activity for passive activity purposes. If so, the S corporation will presumably (once the instructions are released) be directed to provide specific information per the asterisk note on the form.

[1] Edward Zollars, “Draft Schedule K-1, Form 1120S Consolidates §199A Information to a Single Code for 2019,” Current Federal Tax Developments website, July 29, 2019, https://www.currentfederaltaxdevelopments.com/blog/2019/7/29/draft-schedule-k-1-form-1120s-consolidates-199a-information-to-a-single-code-for-2019 (retrieved October 1, 2019)