2019 Form 1040 Schedule 1 Will Ask Taxpayers If They Have Had Virtual Currency Transactions

Just before the extended individual filing deadline for 2018 returns, the IRS released new instructions and a second revision to a Form 1040 Schedule 1 that adds a question related to IRS’s increased interest in virtual currencies.

The IRS has released the complete draft instructions for Form 1040 and Form 1040-SR for 2019[1] and the instructions for Form 8995-A, the form for computing the qualified business income deduction for taxpayers with taxable income in excess of the threshold amount.[2]

The Form 8995-A instructions are much like the previously released Form 8995 instructions, including containing the comment about reducing QBI by charitable contributions related to the business, a position that many found surprising in the “simple” form instructions.

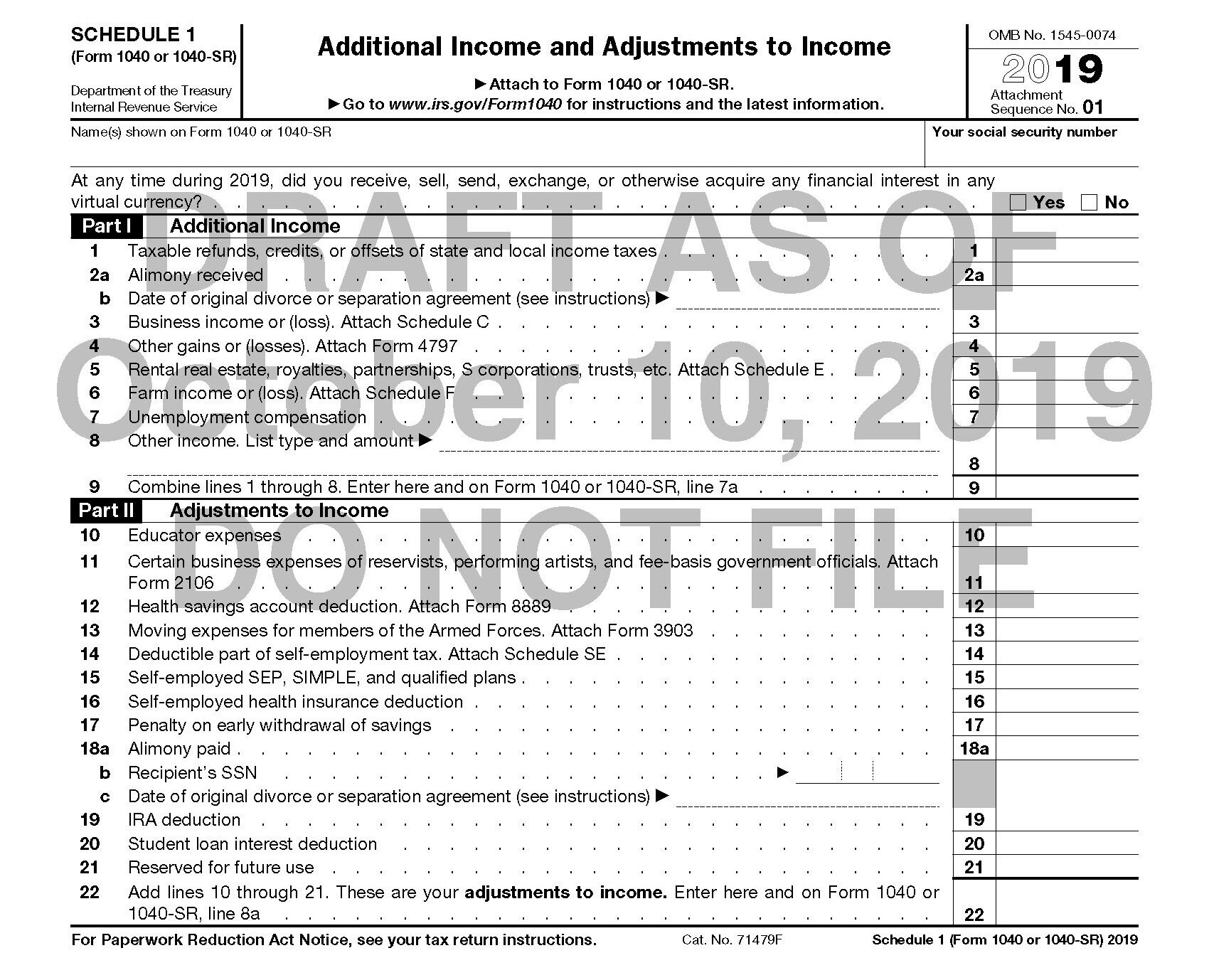

However, the big news was found in the IRS’s release of a second draft of Schedule 1 for Form 1040 and Form 1040-SR.[3] The new revision looks like this:

Draft 2019 Schedule 1, Form 1040 and 1040-SR

The key addition is the question at the top of the form. It reads:

At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?

The taxpayer must answer that question either “yes” or “no” if Schedule 1 is required to be attached to the return.

In the October 11, 2019 e-News for Tax Professionals,[4] the IRS explained why this question was added to the Schedule.

Earlier this week, as part of a wider effort to assist taxpayers and to enforce the tax laws in a rapidly changing area, the Internal Revenue Service issued two new pieces of guidance for taxpayers who engage in transactions involving virtual currency. The new guidance includes Revenue Ruling 2019-24 and frequently asked questions (FAQs). It supplements the guidance the IRS issued on virtual currency in Notice 2014-21 that describes how virtual currency is treated for federal tax purposes.[5]

The IRS has been successful in recent years having penalties for willful failure to file the FBAR form sustained based on the taxpayer having signed a Form 1040 that had Schedule B attached, with the questions regarding foreign bank accounts answered to indicate there were no such accounts. The question on virtual currencies may be used by the IRS in a similar fashion—if the taxpayer fails to report income from virtual currency transactions, if that question is answered “no” that would be evidence the taxpayer had willfully omitted the income.

Any taxpayer that files Schedule 1 must answer that question. But the IRS does clarify in the e-News that a taxpayer will not be forced to file Schedule 1 merely to answer “no” to that question:

Taxpayers who file Schedule 1 to report income or adjustments to income that can’t be entered directly on Form 1040 should check the appropriate box to answer the virtual currency question. Taxpayers do not need to file Schedule 1 if their answer to this question is NO and they do not have to file Schedule 1 for any other purpose.[6]

The IRS has more information on the virtual currency question in the draft Form 1040 and 1040-SR instructions that were released at the same time:

Virtual Currency

If, in 2019, you engaged in any transaction involving virtual currency, check the “Yes” box next to the question on virtual currency at the top of Schedule 1. A transaction involving virtual currency includes:

• The receipt or transfer of virtual currency for free (without providing any consideration), including from an airdrop or following a hard fork;

• An exchange of virtual currency for goods or services;

• A sale of virtual currency; and

• An exchange of virtual currency for other property, including for another virtual currency.

If you disposed of any virtual currency that was held as a capital asset, use Form 8949 to figure your capital gain or loss and report it on Schedule D (Form 1040 or 1040-SR).

If you received any virtual currency as compensation for services or disposed of any virtual currency that you held for sale to customers in a trade or business, you must report the income as you would report other income of the same type (for example, W-2 wages on Form 1040 or 1040-SR, line 1, or inventory or services from Schedule C on Schedule 1).

If, in 2019, you have not engaged in any transaction involving virtual currency, and you don't otherwise have to file Schedule 1, you don’t have to do anything further. If you otherwise have to file Schedule 1, check the “No” box.

Advisers will need to obtain the answer to this question when preparing 2019 tax returns for clients. Presumably the question will be added to the organizer questionnaires by the major tax products.

[1] Draft Form 1040 and 1040-SR Instructions, https://www.irs.gov/pub/irs-dft/i1040gi--dft.pdf, October 10, 2019, retrieved October 11, 2019.

[2] Form 8995-A Instructions, Deduction for Qualified Business Income, https://www.irs.gov/pub/irs-dft/i8995a--dft.pdf, October 10, 2019, retrieved October 11, 2019

[3] Draft Schedule 1, Form 1040 or 1040-SR, Additional Income and Adjustments to Income, https://www.irs.gov/pub/irs-dft/f1040s1--dft.pdf, October 10, 2019, retrieved October 11, 2019

[4] IRS e-News for Tax Professionals, Issue Number: 2019-37, October 11, 2019

[5] IRS e-News for Tax Professionals, Issue Number: 2019-37, October 11, 2019

[6] IRS e-News for Tax Professionals, Issue Number: 2019-37, October 11, 2019