IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on 2019 Income Tax Returns

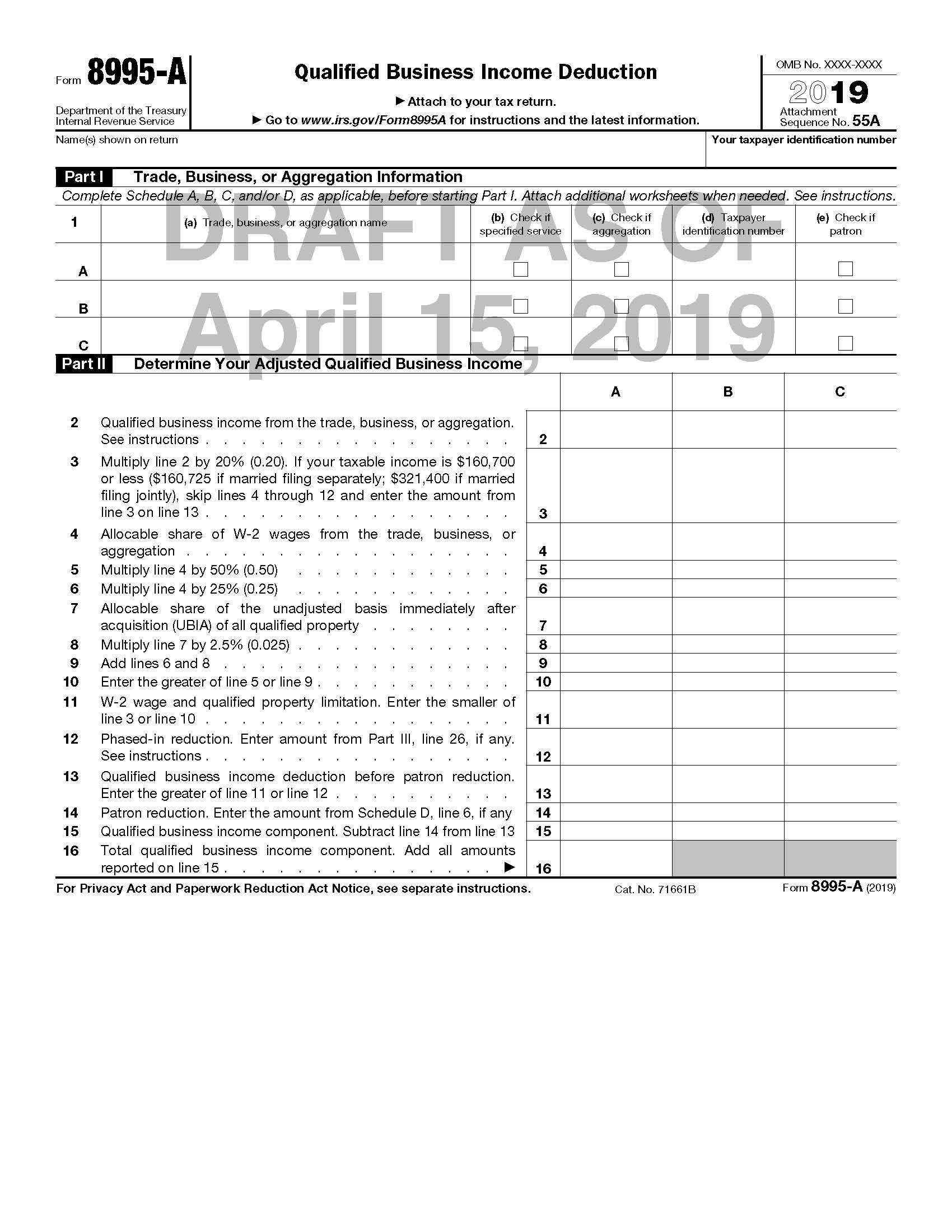

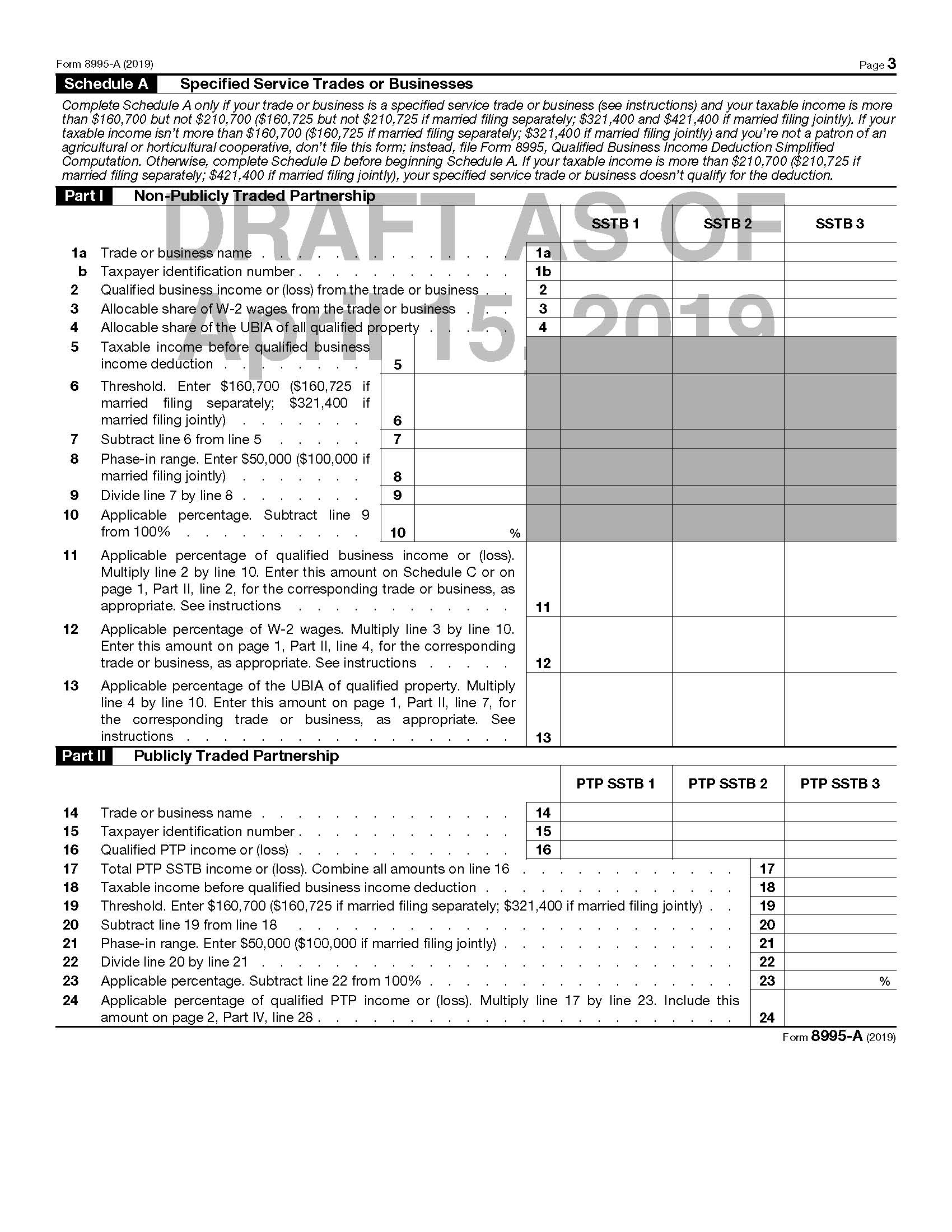

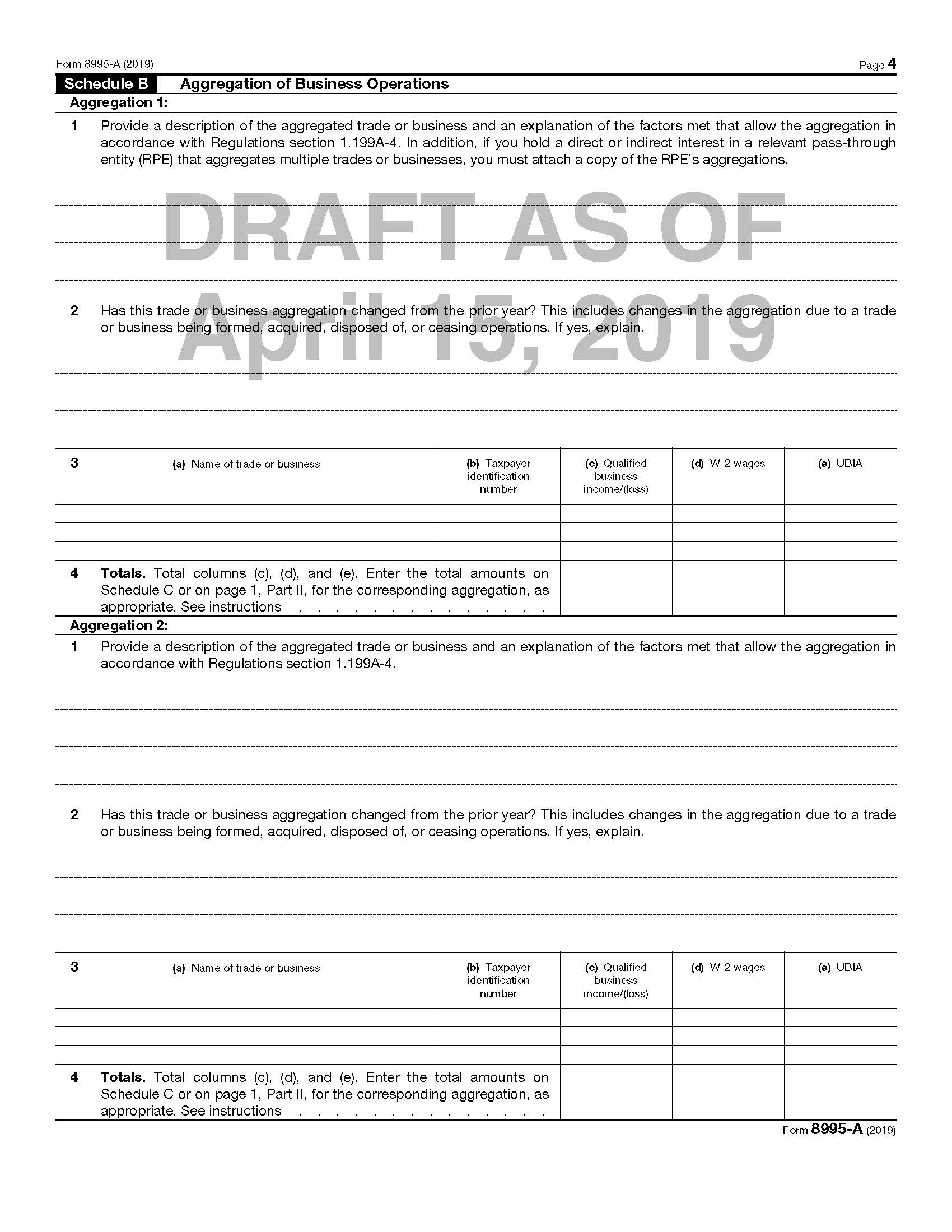

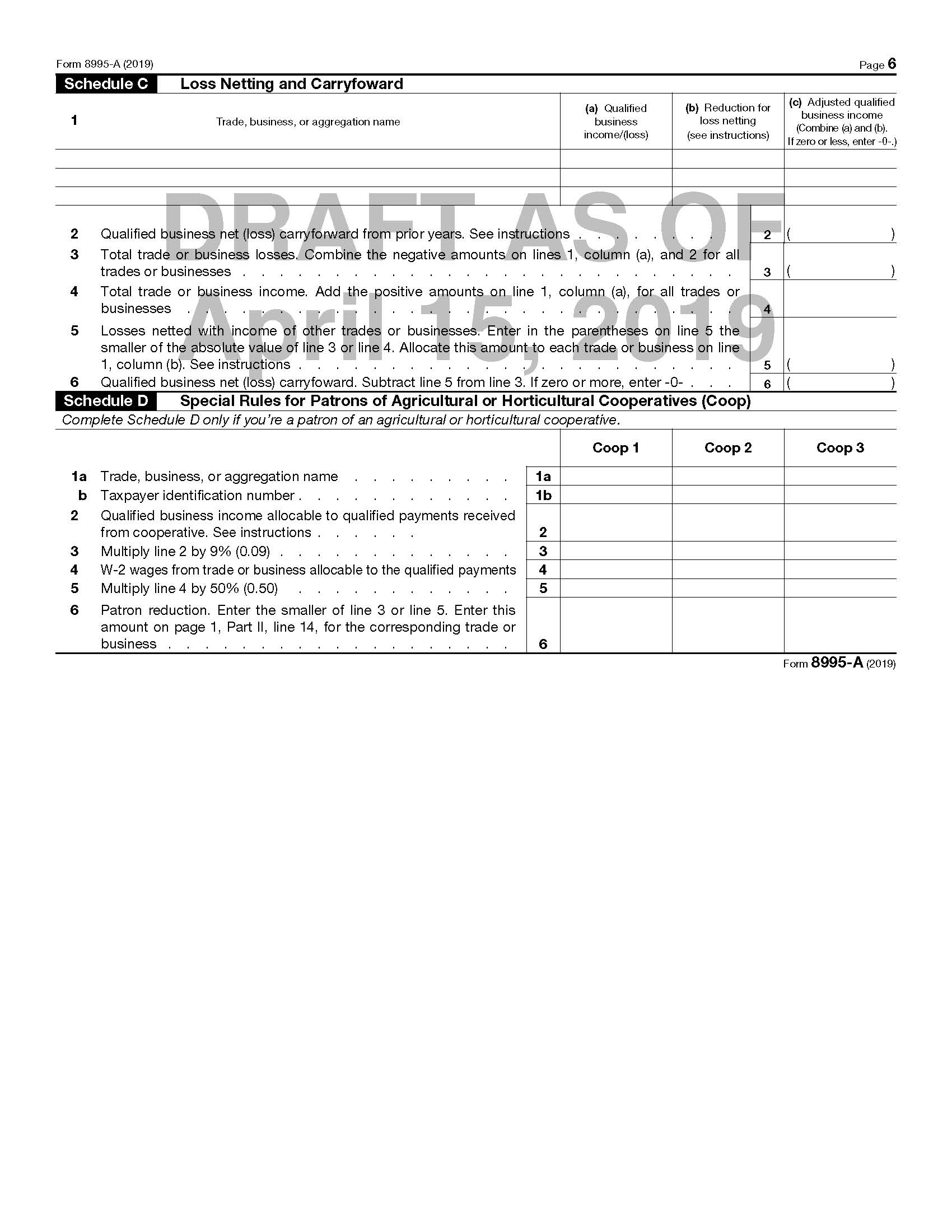

While the IRS did not have time to prepare forms for 2018 returns to calculate the deduction under IRC §199A, on April 16, 2019, just in time for Easter, the IRS released a draft of Form 8995, Qualified Business Income Simplified Computation, and Form 8995-A, Qualified Business Income Deduction.

The drafts of the forms are reproduced below.

The first form is the form to be used by taxpayers who are eligible to use the simplified §199A calculation.

The long form for those are not eligible for the short form is reproduced below: