IRS to Bring Back Form 1099-NEC, Last Used in 1982

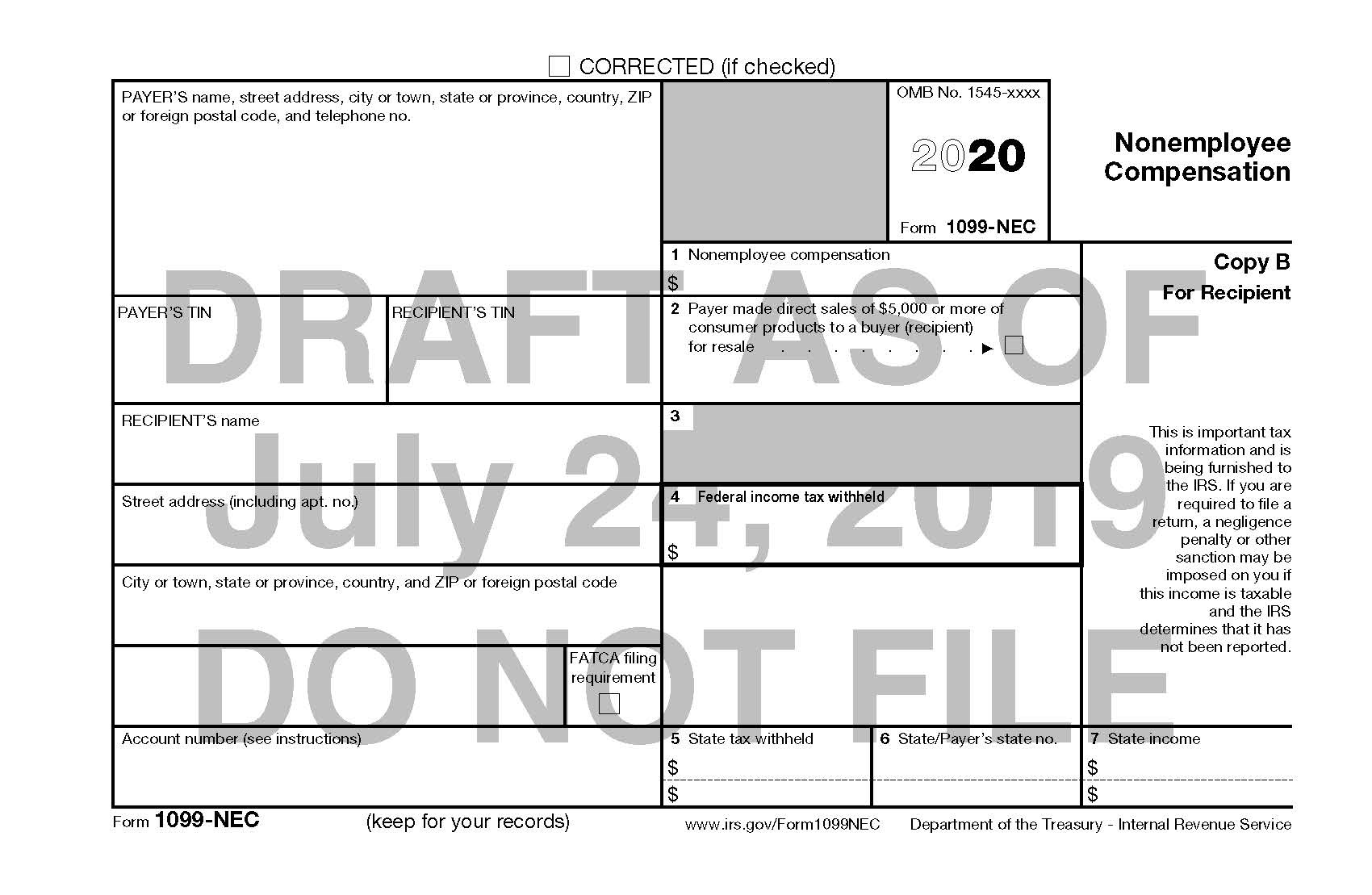

It’s back to the future time—the IRS is bringing back a form last used in the early 1980s when Ronald Reagan was President—Form 1099-NEC, to be used beginning with 2020 information returns. The draft 2020 version of the form has been posted by the IRS to the agency’s website.

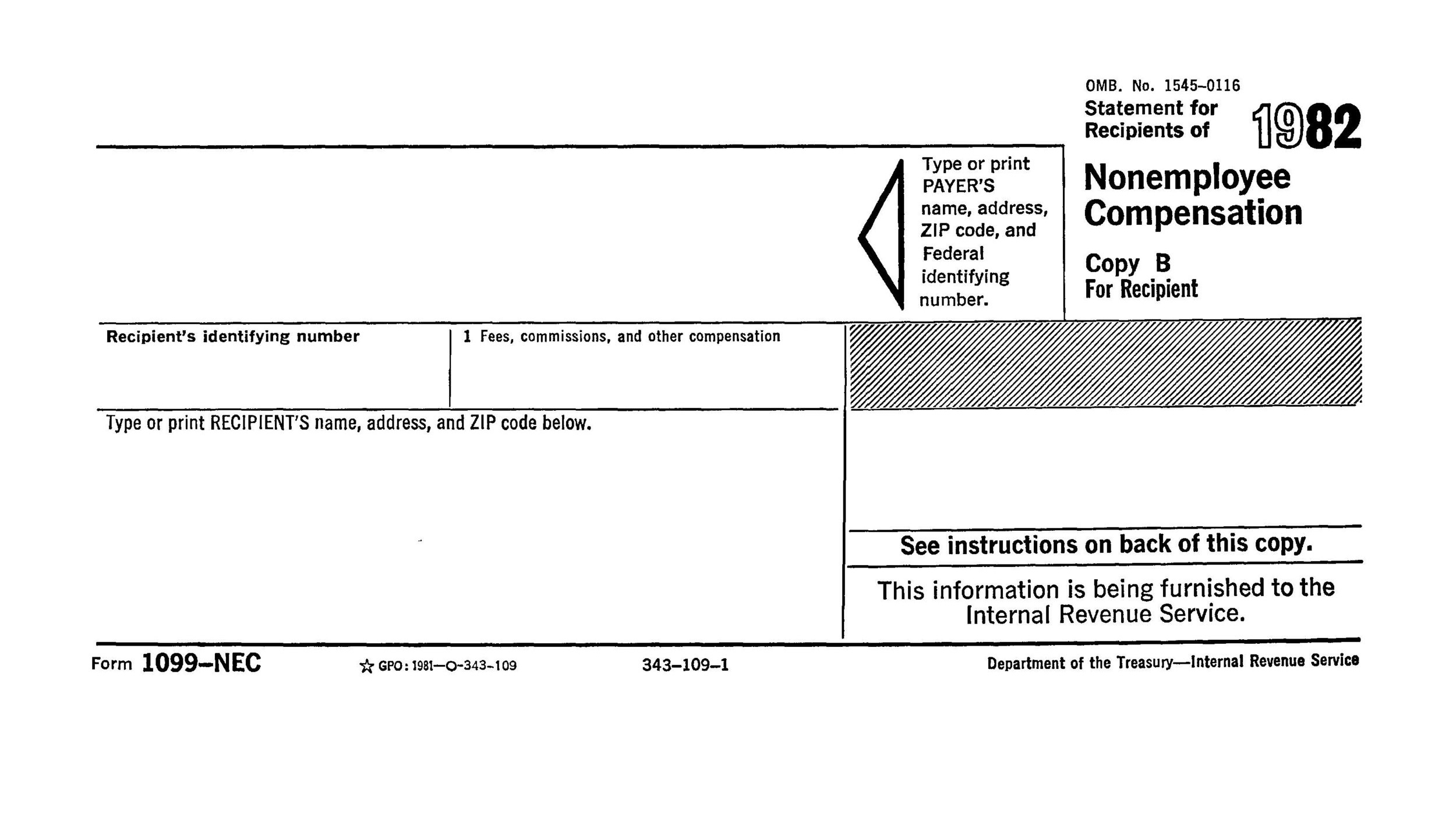

The 1982 version of the form looked like this, harkening back to a much simpler time for tax information reporting:

1982 Form 1099-NEC

The IRS moved the information on the Form 1099-NEC to Form 1099-MISC beginning with payments made in 1983.

However, Congress decided in the Protecting Americans from Tax Hikes Act of 2015 (PATH Act), in an attempt to help reduce refund fraud, to require information returns containing non-employee compensation to be filed with the IRS by January 31. Thus, the due date for your 1099-MISCs are:

March 31 if filed electronically so long the forms do not contain any nonemployee compensation reporting[1] but

January 31 if there is nonemployee compensation to be reported.[2]

Example

Different Due Dates

M Enterprises paid Larry $1,000 for non-employee compensation and Denise $14,000 in rent for 2019. While both Forms 1099-MISC must be given to the recipients by January 31, the one issue to Larry for non-employee compensation must be sent to the IRS by January 31 as well. The 1099-MISC for rent paid to Denise can be held until March 31 just in case an error is found—then only the recipient copy will need to be revised, and no erroneous report would be in the hands of the IRS.

To make matters worse, Tax Analysts reported in March that the IRS computers were unable to apply two different due dates to a batch of Forms 1099-MISC submitted. So a single Form 1099-MISC in a batch submitted after January 31 that had an entry in box 7 for non-employee compensation on it would cause a notice to be issued charging late payment fees on every Form 1099-MISC submitted.[3]

To deal with these complications, the IRS has released a draft of Form 1099-NEC that would first be used to report non-employee compensation paid in 2020. Note that the tax world as it relates to non-employee compensation has grown complex—while the last Form 1099-NEC released by the IRS (the 1982 version) had only one information box in addition to identifying information, the new form has 6 boxes for non-identifying information and added an extra box for state identifying information that was not on the form from nearly 40 years ago.

Draft 2020 Form 1099-NEC

Thus, after one more year of having a dual due date for Forms 1099-MISC, payors will have one due date for each type of 1099 form again.

[1] IRC §6071(b)

[2] IRC §6071(c)

[3] William Hoffman, “IRS May Revive Form 1099-NEC to Reduce Employer Filing Trouble,” Tax Notes Today Federal, March 26, 2019, 2019 TNT 58-6, https://www.taxnotes.com/tax-notes-today-federal/information-reporting/irs-may-revive-form-1099-nec-reduce-employer-filing-trouble/2019/03/26/2996z, (subscription required)