A Look at the SBA's Form 3508S Forgiveness Application for Loans Up to $50,000

The SBA has released the Form 3508S[1] to go along with its new simplified PPP loan forgiveness application process for loans of $50,000 or less, as well as the related instructions.[2]

Application Form

The form consists of two pages. The top portion of the first page contains basic identification and loan related information:

Form 3508S, Loan Information Section

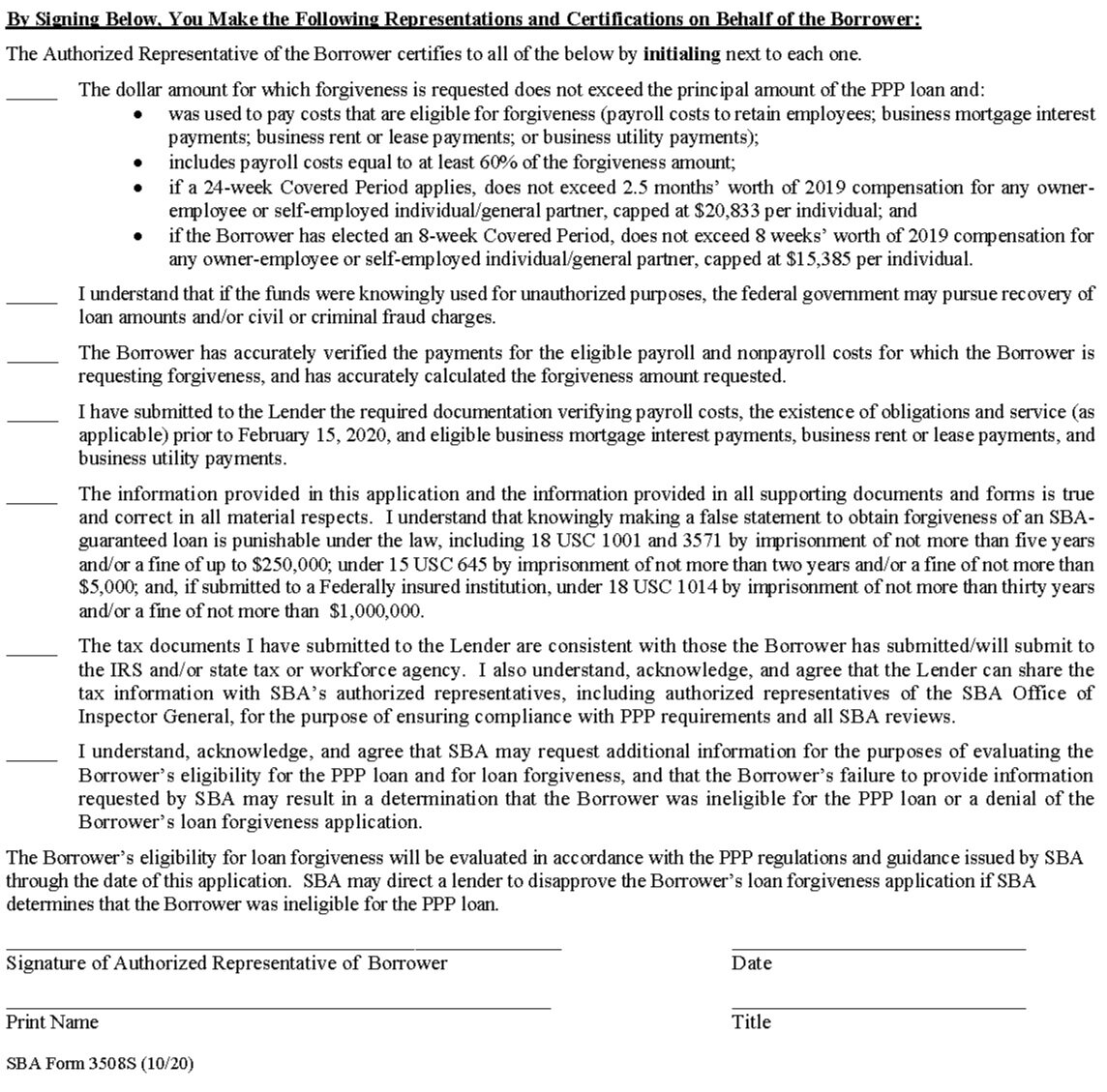

The rest of the page contains the signature of the authorized representative of the borrower along with the representations:

Form 3508S, Certification and Signature Section

The second page consists of the optional borrower demographic information that has been found with each application package.

What is missing from this form when compared even with the Form 3508-EZ is any computation of the forgiveness amount—the borrower just states the amount of forgiveness that is being requested. Only this form and the required documents, which are outlined in the instructions, are to be submitted.

Form 3508S Instructions

The instructions to Form 3508S contain a section outlining the computation of the forgiveness amount. The instructions note:

Enter the total amount of your payroll and nonpayroll costs eligible for forgiveness. The amount entered cannot exceed the principal amount of the PPP loan. Use the following instructions to determine your forgiveness amount.[3]

While a detailed computation is not being sent with the application for forgiveness, the borrower will need to be able to provide the detailed support if requested, as the instructions note in the section titled “Documents that Each Borrower Must Maintain but is Not Required to Submit”:

All records relating to the Borrower’s PPP loan, including documentation submitted with its PPP loan application, documentation supporting the Borrower’s certifications as to its eligibility for a PPP loan, documentation necessary to support the Borrower’s loan forgiveness application, and documentation demonstrating the Borrower’s material compliance with PPP requirements. The Borrower must retain all such documentation in its files for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request.[4]

The instructions provide the standard information that has been provided on prior forms for the types of expenses eligible to be used in the forgiveness calculation, as well as the caveat that non-payroll costs can amount to no more than 40% of the forgiveness amount.[5]

Even with the simplified application there are documents that must be submitted with the forgiveness application. The instructions provide that a borrower using Form 3508S must submit the following items with the application:

Payroll: Documentation verifying the eligible cash compensation and non-cash benefit payments from the Covered Period or the Alternative Payroll Covered Period consisting of each of the following:

a. Bank account statements or third-party payroll service provider reports documenting the amount of cash compensation paid to employees.

b. Tax forms (or equivalent third-party payroll service provider reports) for the periods that overlap with the Covered Period or the Alternative Payroll Covered Period:

i. Payroll tax filings reported, or that will be reported, to the IRS (typically, Form 941); and

ii. State quarterly business and individual employee wage reporting and unemployment insurance tax filings reported, or that will be reported, to the relevant state.

c. Payment receipts, cancelled checks, or account statements documenting the amount of any employer contributions to employee health insurance and retirement plans that the Borrower included in the forgiveness amount.

Nonpayroll: Documentation verifying existence of the obligations/services prior to February 15, 2020 and eligible payments from the Covered Period.

a. Business mortgage interest payments: Copy of lender amortization schedule and receipts or cancelled checks verifying eligible payments from the Covered Period; or lender account statements from February 2020 and the months of the Covered Period through one month after the end of the Covered Period verifying interest amounts and eligible payments.

b. Business rent or lease payments: Copy of current lease agreement and receipts or cancelled checks verifying eligible payments from the Covered Period; or lessor account statements from February 2020 and from the Covered Period through one month after the end of the Covered Period verifying eligible payments.

c. Business utility payments: Copy of invoices from February 2020 and those paid during the Covered Period and receipts, cancelled checks, or account statements verifying those eligible payments.[6]

While these documents are being submitted, apparently the lender merely will need to confirm that the documents have been submitted and will not be asked to actually verify the forgiveness calculation itself per the interim final rules released at the same time as the new application.[7]

[1] Paycheck Protection Program PPP Loan Forgiveness Application Form 3508S, October 8, 2020, https://home.treasury.gov/system/files/136/PPP-Loan-Forgiveness-Application-Form-3508S.pdf (retrieved October 9, 2020)

[2] PPP Loan Forgiveness Application Form 3508S Instructions for Borrowers, October 8, 2020, https://home.treasury.gov/system/files/136/PPP-Loan-Forgiveness-Application-Form-3508S-Instructions.pdf (retrieved October 9, 2020)

[3] PPP Loan Forgiveness Application Form 3508S Instructions for Borrowers, p. 1

[4] PPP Loan Forgiveness Application Form 3508S Instructions for Borrowers, p. 3

[5] PPP Loan Forgiveness Application Form 3508S Instructions for Borrowers, pp. 1-2

[6] PPP Loan Forgiveness Application Form 3508S Instructions for Borrowers, p. 3

[7] RIN 3245-AH59, October 8, 2020, Section III.2.b, p. 9, https://home.treasury.gov/system/files/136/PPP--IFR--Additional-Revisions-Loan-Forgiveness-Loan-Review-Procedures-Interim-Final-Rules.pdf (retrieved October 9, 2020)