PPP Loan Forgiveness Application and Instructions Released by SBA

The SBA has released the “Paycheck Protection Program Loan Forgiveness Application”[1] that contains information on the PPP forgiveness program.

The application consists of:

The PPP Loan Forgiveness Calculation Form;

PPP Schedule A;

The PPP Schedule A Worksheet; and

The (optional) PPP Borrower Demographic Information Form.

Application Form

The application and instructions are the first detailed guidance from the SBA and Treasury regarding details of computing the debt forgiveness. While not answering every question borrowers had about the program, it does clarify a number of issues.

Some of the key items clarified include:

The “incurred” and “paid” language in §1106 of the CARES Act regarding expenses that count for forgiveness is defined to allow, with certain limitations, both expenses paid and incurred in the 8-week period;

A relatively borrower friendly interpretation of the calculation of both the full-time equivalent and wage/salary reduction provisions that would reduce the amount of debt forgiven;

An indirect bar on using bonuses to owner employees to fill shortfalls in eligible expenses used to apply for loan forgiveness buried in the representations;

An explicit statement that covered rent obligations include leases on both real and personal property; and

The creation of a new Alternative Payroll Covered Period that allows borrowers to align the 56-day period with their own payroll period.

The instructions first look at the following two-page application form.

SBA PPP Loan Forgiveness Application Page 1

SBA PPP Loan Forgiveness Application Page 2

Computing Payroll Costs and Forgiveness

The first page has instructions for the PPP Loan Forgiveness Calculation Form. The covered period is defined as follows:

Enter the eight-week (56-day) Covered Period of your PPP loan. The first day of the Covered Period must be the same as the PPP Loan Disbursement Date. For example, if the Borrower received its PPP loan proceeds on Monday, April 20, the first day of the Covered Period is April 20 and the last day of the Covered Period is Sunday, June 14.

But the instructions go on to provide a second optional covered period that a borrower can choose:

For administrative convenience, Borrowers with a biweekly (or more frequent) payroll schedule may elect to calculate eligible payroll costs using the eight-week (56-day) period that begins on the first day of their first pay period following their PPP Loan Disbursement Date (the “Alternative Payroll Covered Period”). For example, if the Borrower received its PPP loan proceeds on Monday, April 20, and the first day of its first pay period following its PPP loan disbursement is Sunday, April 26, the first day of the Alternative Payroll Covered Period is April 26 and the last day of the Alternative Payroll Covered Period is Saturday, June 20. Borrowers who elect to use the Alternative Payroll Covered Period must apply the Alternative Payroll Covered Period wherever there is a reference in this application to “the Covered Period or the Alternative Payroll Covered Period.”

But borrowers electing to use the Alternative Payroll Covered Period will find that in some cases the regular Covered Period beginning on the day the funds are deposited in their account must be used instead. The instructions note

However, Borrowers must apply the Covered Period (not the Alternative Payroll Covered Period) wherever there is a reference in this application to “the Covered Period” only.

Generally, only payroll related items will be allowed to use the Alternative Payroll Covered Period, while payments on other expenses will continue to refer to the 56-day period beginning on the date the loan funds are deposited into the borrower’s account.

The instructions do require those borrowers that, along with any affiliates, borrowed more than $2 million, to check a box indicating that on the Form.

The specific instructions for the first four lines read:

Line 1: Enter total eligible payroll costs incurred or paid during the Covered Period or the Alternative Payroll Covered Period.

Line 2: Enter the amount of business mortgage interest payments during the Covered Period for any business mortgage obligation on real or personal property incurred before February 15, 2020. Do not include prepayments.

Line 3: Enter the amount of business rent or lease payments for real or personal property during the Covered Period, pursuant to lease agreements in force before February 15, 2020.

Line 4: Enter the amount of business utility payments during the Covered Period, for business utilities for which service began before February 15, 2020.

NOTE: For lines 2-4, you are not required to report payments that you do not want to include in the forgiveness amount.

Payroll Costs Paid and Incurred in the Covered Period (or Alternative Payroll Covered Period)

The instructions contain information on costs eligible for forgiveness. The first costs detailed are payroll costs. The instructions provide the following detail on eligible payroll costs:

Eligible payroll costs. Borrowers are generally eligible for forgiveness for the payroll costs paid and payroll costs incurred during the eight-week (56-day) Covered Period (or Alternative Payroll Covered Period) (“payroll costs”).

A subtle wording issue here has major implications. While CARES Act §1106(b) refers to payroll costs eligible to be counted towards forgiveness as “costs incurred and payments made” during the covered period, the instructions repeat the word “payroll costs” for each clause, making it clear that these are separate ways a payroll cost may become part of the forgiveness calculation. The clause in the law could have been read either as requiring a cost meet both tests or that costs meeting either test would be acceptable. The SBA has chosen the latter reading—at least generally.

As the instructions will continue to make clear, a borrower can count for the forgiveness calculation:

Eligible costs paid during the 56-day period regardless of when they were incurred and

Eligible costs incurred during the 56-day period so long as they are paid by a standard payment date defined for each cost type.

If a cost is both incurred in the period and paid during the period, it can only be counted once towards forgiveness.

Buried in the certification is also a special limit on the amount of payroll costs that can count for owner-employees. At the end of the first certification is found the following language regarding items included in the dollar amount for which forgiveness is requested, certifying that the amount requested:

…does not exceed eight weeks’ worth of 2019 compensation for any owner-employee or self-employed individual/general partner, capped at $15,385 per individual.

Presumably eight weeks’ worth of 2019 compensation would be the owner-employee’s W-2 wages multiplied by 8/52. This would serve to limit the ability of a corporation to attempt to cram in a bonus to get an owner-employee who had less than $100,000 in 2019 cash compensation up to the $15,385 maximum amount per individual for the forgiveness calculation.

Similarly, the lack of any such language as it relates to other employees suggests that a bonus is acceptable to be paid to other employees.

The instructions have the following definitions that apply to payroll costs paid and to payroll costs incurred.

Payroll costs are considered paid on the day that paychecks are distributed or the Borrower originates an ACH credit transaction. Payroll costs are considered incurred on the day that the employee’s pay is earned.

Concerns had been raised regarding the use of the terms “paid” and “incurred” in referring to costs eligible to be used for the forgiveness calculation. In the instructions the SBA has decided those are two independent tests for forgiveness—and provide that costs incurred before the end of the 56-day period will count towards forgiveness if they are paid on or before the next regular payroll date:

Payroll costs incurred but not paid during the Borrower’s last pay period of the Covered Period (or Alternative Payroll Covered Period) are eligible for forgiveness if paid on or before the next regular payroll date. Otherwise, payroll costs must be paid during the Covered Period (or Alternative Payroll Covered Period). For each individual employee, the total amount of cash compensation eligible for forgiveness may not exceed an annual salary of $100,000, as prorated for the covered period.

The inclusion of this provision eliminates the need to schedule a special payroll to be paid on day 56 of the applicable covered period. Rather, a portion of the first payroll paid after the end of the 56-day period will still count towards debt forgiveness.

However, borrowers are not allowed to count payroll costs twice—so costs that are both paid and incurred in the 56-day period only count once towards forgiveness.

Count payroll costs that were both paid and incurred only once. For information on what qualifies as payroll costs, see Interim Final Rule on Paycheck Protection Program posted on April 2, 2020 (85 FR 20811).

Other Eligible Costs

The instructions then go on to provide information on other costs that can be used for forgiveness. A similar set of “paid” and “incurred” definitions apply to these costs:

Nonpayroll costs eligible for forgiveness consist of:

(a) covered mortgage obligations: payments of interest (not including any prepayment or payment of principal) on any business mortgage obligation on real or personal property incurred before February 15, 2020 (“business mortgage interest payments”);

(b) covered rent obligations: business rent or lease payments pursuant to lease agreements for real or personal property in force before February 15, 2020 (“business rent or lease payments”); and

(c) covered utility payments: business payments for a service for the distribution of electricity, gas, water, transportation, telephone, or internet access for which service began before February 15, 2020 (“business utility payments”).

An eligible nonpayroll cost must be paid during the Covered Period or incurred during the Covered Period and paid on or before the next regular billing date, even if the billing date is after the Covered Period. Eligible nonpayroll costs cannot exceed 25% of the total forgiveness amount. Count nonpayroll costs that were both paid and incurred only once.

The instructions limit the use of the 75% payroll cost test the SBA proposed to apply solely to the maximum forgiveness amounts. Some lenders had indicated that there was going to be a 75% cliff rule—75% of the loan proceeds had to be used for payroll costs or there would be no portion of the loan forgiven. The SBA instructions indicate the agency has not decided to implement such a rule.

Note that use of the Alternative Payroll Covered Period is not permitted for these expenses. Thus, there will be two different periods to measure for any borrower who has elected the Alternative Payroll Covered Period for payroll.

Example

Circles Manufacturing applied for and received a Payroll Protection Program loan. The loan proceeds were deposited into the company’s bank account on Thursday, May 14, 2020. Circles first pay period following the loan distribution date begins on the following Monday, May 18, 2020.

If Circles Manufacturing elects to use the Alternative Payroll Covered Period:

The Alternative Payroll Covered Period will run from Monday, May 18, 2020 until Sunday July 12, 2020. This time period will be used to measure payroll costs incurred and paid for loan forgiveness.

The Covered Period for all other expenses will run from Thursday, May 14 until Wednesday, July 8, 2020. Thus, the other expenses must be incurred and paid during that time period.

The “paid” and “incurred” issue for non-payroll costs is also resolved in a manner similar to the resolution of the payroll costs issue.

EXAMPLE

Circles is billed by American Utility for electricity on a calendar month basis. Circles pays for utilities promptly on the first day of a month for electricity used in the prior month. The electrical utility costs that count as a cost that could support forgiveness related to non-payroll expenses are:

The entire amounts paid on June 1 and July 1 for electricity used in May and June. Both are paid during the Covered Period. Per the instructions, it does not appear that Circles will need to prorate the May electric bill to exclude electricity used before May 14, since the entire May utility charge was paid in the Covered Period.

The portion of the invoice for July paid on August 1 that relates to electricity used from July 1, 2020 to July 8, 2020. While this invoice was not paid during the Covered Period, the portion of electricity costs covering July 1 to July 8 were incurred during the Covered Period and paid on the next regular billing date.

The “billing date” requirement is not completely clear, but it seems likely the agency means the due date for payment of the bill that contains the “incurred” period. Note that it will be important to insure that these “end of period” bills are paid timely—per the instructions, if the bill is not paid on time these costs would not count towards forgiveness.

Other Items on the Application

Lines 5-7 computes any reduction in the loan due to a reduction in full-time equivalents (FTEs) or salary/wage reductions, with supporting calculations on PPP Schedule A. Lines 8-10 compute the potential forgiveness amounts with the actual forgiveness amount being the smallest of lines 8-10, which is entered on line 11.

The borrower’s authorized representative initials the representations on the second page of the application and signs at the bottom of that page.

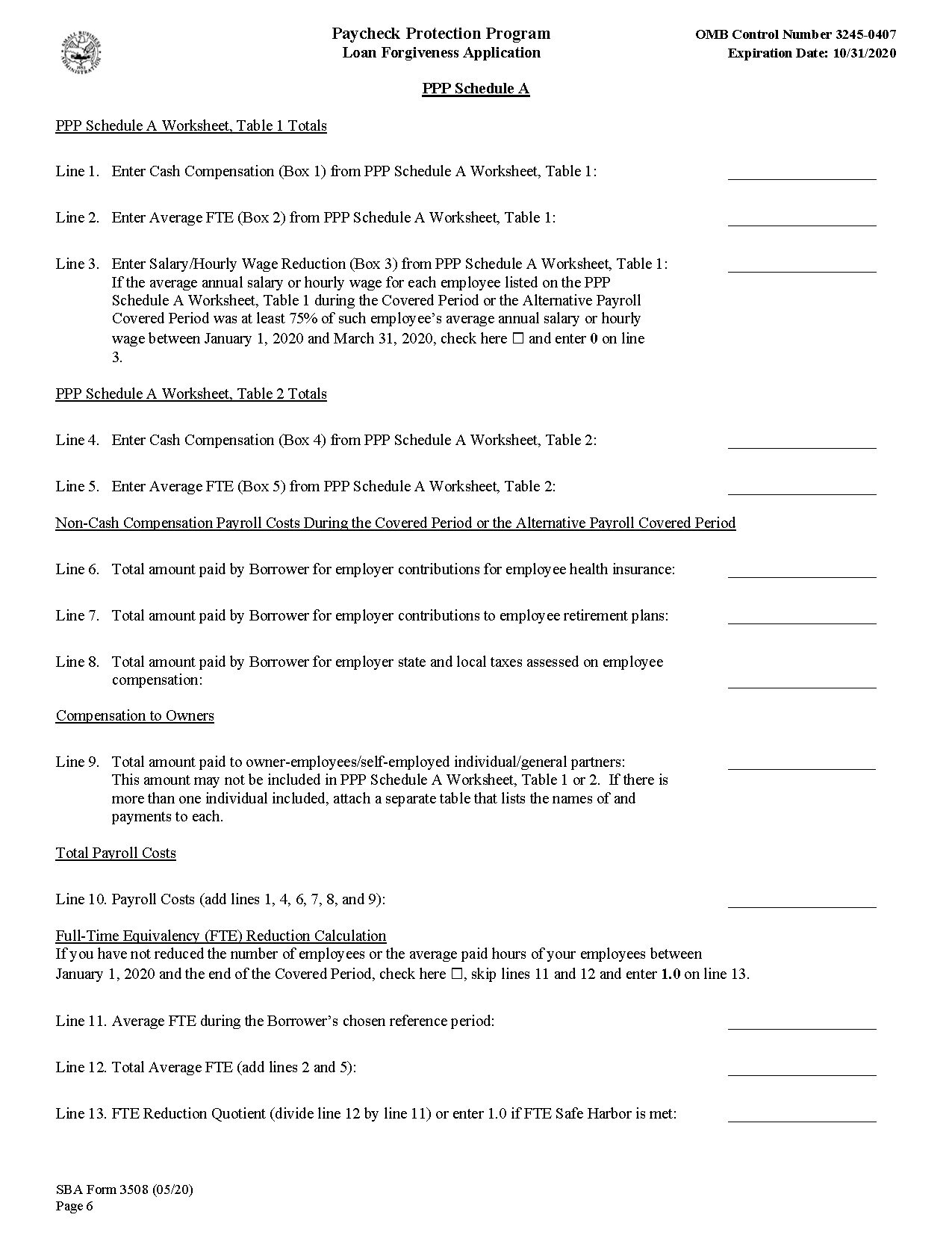

PPP Schedule A

The package next contains PPP Schedule A which computes the FTE and/or payroll rate reductions in the amount of the loan that may be forgiven.

PPP Schedule A reads as follows:

PPP Loan Forgivness Application: PPP Schedule A

Lines 1-3 report information related to employees other than owner-employees, self-employed individuals or partners who had annualized compensation of less than $100,000 for every pay period in 2019 or were not employed in 2019. This information will come from PPP Schedule A Worksheet Table 1.

A reduction in pay amount reported on line 3 is carried to line 5 of the loan forgiveness application form.

Lines 4 and 5 list information from PPP Schedule A Worksheet Table 2 related to employees who are not owner-employees, self-employed or partners, and who received annualized compensation from the borrower during 2019 of over $100,000 for any pay period in 2019. These employees, while part of the FTE calculation, are not included in the calculation of any forgiveness reduction based on a reduction in pay.

Line 9 includes information on amounts paid to owners. The instructions provide:

Enter any amounts paid to owners (owner-employees, a self-employed individual, or general partners). This amount is capped at $15,385 (the eight-week equivalent of $100,000 per year) for each individual or the eight-week equivalent of their applicable compensation in 2019, whichever is lower. See Interim Final Rule on Additional Eligibility Criteria and Requirements for Certain Pledges of Loans posted on April 14, 2020 for more information (85 FR 21747, 21749).

The exclusion of these amounts from Table 1 or Table 2 means they will not enter into the calculation of the FTE or reduction in pay calculations for the borrower. Note, as well, the application does not contain a definition of who exactly qualifies as an “owner-employee” for this form. Thus, we have no information on whether a small minority interest held by an employee would result in that employee being treated as an owner-employee for these purposes or any other time the term is used in the document.

There is also no mention of whether any sort of related party attribution rule will apply—that is, does the minor child of the 100% owner of the business count as an owner-employee or not? And what about the spouse of the owner? In a community property state presumably both spouses will be owner-employees if the business asset is community property.

Lines 6-8 add in the non-cash items paid by the borrower for employees:

Line 6: Enter the total amount paid by the Borrower for employer contributions for employee health insurance, including employer contributions to a self-insured, employer-sponsored group health plan, but excluding any pre-tax or after tax contributions by employees.

Line 7: Enter the total amount paid by the Borrower for employer contributions to employee retirement plans, excluding any pre-tax or after-tax contributions by employees.

Line 8: Enter the total amount paid by the Borrower for employer state and local taxes assessed on employee compensation (e.g., state unemployment insurance tax); do not list any taxes withheld from employee earnings.

Note that each item only includes amounts paid to employee programs. Nothing on the application says these amounts will not include payments for owner-employees, though prior IFR guidance for self-employed individuals indicated that these costs would not count for the self-employed.

Since self-employed individuals and partners of a partnership are not employees, the wording would seem to exclude benefits allocable to either category from being considered a payroll cost. And, alternatively, since a shareholder of a corporation will be treated as the employee of the corporation for compensation for any services performed, the benefits for the owner-employee would appear to count in this calculation.

Example

Alice owns 100% of the stock of Underdog Pet Care, Inc. In addition to counting the cash compensation paid to Alice as a payroll cost, the corporation can also count the amounts paid during the appropriate covered period for health care plan employer contributions, retirement plan employer contributions and state payroll taxes on Alice’s compensation during the period. Alice is an employee of Underdog Pet Care, Inc.

However, if Underdog Pet Care was operated as a sole proprietorship with Alice being the proprietor, those additional payroll costs could not be considered in the forgiveness calculation to the extend they related to Alice. Alice is not an employee of Underdog Pet Care.

Line 10 totals the payroll costs listed on PPP Schedule A, with the amount carried to line 1 of the PPP Loan Forgiveness Calculation Form.

Lines 11-13 calculate the FTE reduction quotient. The details of that reduction are discussed later in this article.

Salary and FTE Reduction Calculation Tables (PPP Schedule A Worksheet Tables 1 and 2)

Table 1 lists employees who must be considered for the salary reduction rules that can reduce loan forgiveness. Employees to be listed in this table are all employees except:

Owner-employees, self-employed individuals and partners;

Other employees who had annualized salaries for any pay period in 2019 of over $100,000 and

Other employees who did not work for the taxpayer in 2019.

The table is reproduced below:

Table 1

The instructions provide the following details for the last three columns in the table. The first one to be described is cash compensation:

Cash Compensation: Enter the sum of gross salary, gross wages, gross tips, gross commissions, paid leave (vacation, family, medical or sick leave, not including leave covered by the Families First Coronavirus Response Act), and allowances for dismissal or separation paid or incurred during the Covered Period or the Alternative Payroll Covered Period. For each individual employee, the total amount of cash compensation eligible for forgiveness may not exceed an annual salary of $100,000, as prorated for the Covered Period; therefore, do not enter more than $15,385 in Table 1 or Table 2 for any individual employee.

The next item defined is average FTE. Note that the amount is computed separately for each employee, 40 hours is used as the full time base, and no single employee can be more than one full-time equivalent:

Average FTE: This calculates the average full-time equivalency (FTE) during the Covered Period or the Alternative Payroll Covered Period. For each employee, enter the average number of hours paid per week, divide by 40, and round the total to the nearest tenth. The maximum for each employee is capped at 1.0.

If a taxpayer does not have detailed records to calculate actual hours, or simply decides not to use the detailed calculation, the instruction provide a simplified method for determining FTEs. Note that if an employer’s part-time employees primarily work 20-40 hours, the alternative method likely will produce a lower FTE number. It seems likely the SBA will require the employer to use the simplified method for all calculations if it is elected—the employer cannot use the simplified method to compute the FTEs for the reference period, but actual hours for the appropriate covered period.

A simplified method that assigns a 1.0 for employees who work 40 hours or more per week and 0.5 for employees who work fewer hours may be used at the election of the Borrower.

The instructions go on to describe the complexities of dealing with the FTE calculation and restoration of FTE briefly.

This calculation will be used to determine whether the Borrower’s loan forgiveness amount must be reduced due to a statutory requirement concerning reductions in full-time equivalent employees. Borrowers are eligible for loan forgiveness for certain expenditures during the Covered Period or the Alternative Payroll Covered Period. However, the actual loan forgiveness amount that the Borrower will receive may be less, depending on whether the Borrower’s average weekly number of FTE employees during the Covered Period or the Alternative Payroll Covered Period was less than during the Borrower’s chosen reference period (see Instructions to PPP Schedule A, Line 11). The Borrower is exempt from such a reduction if the FTE Reduction Safe Harbor applies. See the FTE Reduction Safe Harbor instructions below.

The final column definition is for the salary reduction column:

Salary/Hourly Wage Reduction: This calculation will be used to determine whether the Borrower’s loan forgiveness amount must be reduced due to a statutory requirement concerning reductions in employee salary and wages. Borrowers are eligible for loan forgiveness for certain expenditures during the Covered Period or the Alternative Payroll Covered Period. However, the actual amount of loan forgiveness the Borrower will receive may be less, depending on whether the salary or hourly wages of certain employees during the Covered Period or the Alternative Payroll Covered Period was less than during the period from January 1, 2020 to March 31, 2020. If the Borrower restored salary/hourly wage levels, the Borrower may be eligible for elimination of the Salary/Hourly Wage Reduction amount. Borrowers must complete this worksheet to determine whether to reduce the amount of loan forgiveness for which they are eligible. Complete the Salary/Hour Wage Reduction column only for employees whose salaries or hourly wages were reduced by more than 25% during the Covered Period or the Alternative Payroll Covered Period as compared to the period of January 1, 2020 through March 31, 2020.

Table 2 contains information for employees that are not in Table 1 and are not owner-employees, self-employed or partners. Essentially, those employees that had at least one pay period in 2019 with an annualized salary of more than $100,000 are listed in this table. These employees factor into the FTE calculation but not the salary reduction calculation—thus you find no salary/wage reduction column in this table.

The table is reproduced below:

Table 2

Salary/Wage Reduction Calculation for Table 1

The instructions require the borrower to perform the following steps to determine if there is a salary/wage reduction adjustment separately for each employee listed in Table 1. The calculation uses salary for salaried employees and hourly wage for hourly employees:

Step 1. Determine if pay was reduced more than 25%.

a. Enter average annual salary or hourly wage during Covered Period or Alternative Payroll Covered Period: ______________.

b. Enter average annual salary or hourly wage between January 1, 2020 and March 31, 2020: ______________.

c. Divide the value entered in 1.a. by 1.b.: ______________.

If 1.c. is 0.75 or more, enter zero in the column above box 3 for that employee; otherwise proceed to Step 2.

Step 2. Determine if the Salary/Hourly Wage Reduction Safe Harbor is met.

a. Enter the annual salary or hourly wage as of February 15, 2020: ______________.

b. Enter the average annual salary or hourly wage between February 15, 2020 and April 26, 2020: ______________.

If 2.b. is equal to or greater than 2.a., skip to Step 3. Otherwise, proceed to 2.c.

c. Enter the average annual salary or hourly wage as of June 30, 2020: ______________.

If 2.c. is equal to or greater than 2.a., the Salary/Hourly Wage Reduction Safe Harbor has been met – enter zero in the column above box 3 for that employee. Otherwise proceed to Step 3.

Step 3. Determine the Salary/Hourly Wage Reduction.

a. Multiply the amount entered in 1.b. by 0.75: ______________.

b. Subtract the amount entered in 1.a. from 3.a.: ______________.

The instructions provide the following calculation of the salary/wage reduction amount for an hourly worker:

If the employee is an hourly worker, compute the total dollar amount of the reduction that exceeds 25% as follows:

c. Enter the average number of hours worked per week between January 1, 2020 and March 31, 2020: ______________.

d. Multiply the amount entered in 3.b. by the amount entered in 3.c. ______________. Multiply this amount by 8: ______________. Enter this value in the column above box 3 for that employee.

If the employee in question is salaried, the following computation of the salary/wage reduction amount is used:

If the employee is a salaried worker, compute the total dollar amount of the reduction that exceeds 25% as follows:

e. Multiply the amount entered in 3.b. by 8: ______________. Divide this amount by 52: ______________. Enter this value in the column above box 3 for that employee.

Note that the SBA tables do not include any employee in Table 1 that did not work for the employee during the 56-day period. This is an employer friendly view of how the salary reduction rules work. Many commentators feared that if an employee had been employed in the prior quarter, that a salary/wage reduction penalty would apply for that employee.

Also, the SBA did not interpret the rule to mean that the employee had to receive 75% of the prior quarter’s salary or wages in the 8-week period, a reading that a number of parties believed might be how this provision should be interpreted. This also is a very borrower friendly interpretation of the rules. It is only a reduction in annualized salary or wage rates that will cause an issue leading to a loss of a certain amount of forgiven debt.

Also, the application applies this rule before the FTE reduction takes place. This ordering produces a smaller reduction in the amount of forgiveness than would ordering the two reductions the other way—the FTE reduction effectively serves to reduce the salary/wage reduction proportionately.

FTE Reduction Rules

The general FTE reduction rules are found on lines 11-13 of PPP Schedule A.

Line 11 looks for the average full-time equivalents for the taxpayer’s “reference period.” The instructions provide that the reference period for a borrower is, at the borrower’s election, either:

February 15, 2019 to June 30, 2019;

January 1, 2020 to February 29, 2020; or

In the case of seasonal employers, either of the preceding periods or a consecutive twelve-week period between May 1, 2019 and September 15, 2019.

As should be obvious, the borrower would wish to select the period available to the borrower that results in the lowest FTE calculation.

The instructions provide the following information for calculating the FTE numbers for the reference period:

For each employee, follow the same method that was used to calculate Average FTE on the PPP Schedule A Worksheet. Sum across all employees during the reference period and enter that total on this line.

This average that is computed for line 11 is then divided by the total of the FTE from Tables 1 and 2 of the PPP Schedule A Worksheets. If that number is less than 1.0, the amount of loan forgiveness would be reduced by multiplying the ratio by the forgiveness amount computed after any reduction based on reduction of salary/wages.

However, there are a pair of safe harbors that can reduce or eliminate the impact of this calculation.

FTE Reduction Exception (Employee Refused to Return to Work)

The first exception removes an employee from the FTE calculation if he/she refused a qualified offer of employment for the same hours at the same rate and no replacement employee was hired. The instructions provide:

Indicate the FTE of (1) any positions for which the Borrower made a good-faith, written offer to rehire an employee during the Covered Period or the Alternative Payroll Covered Period which was rejected by the employee; and (2) any employees who during the Covered Period or the Alternative Payroll Covered Period (a) were fired for cause, (b) voluntarily resigned, or (c) voluntarily requested and received a reduction of their hours. In all of these cases, include these FTEs on this line only if the position was not filled by a new employee. Any FTE reductions in these cases do not reduce the Borrower’s loan forgiveness.

FTE Reduction Safe Harbor

The second exception may allow a borrower to escape penalty for an FTE reduction if the employer had reduced its FTEs for the period from February 15, 2020 to April 26, 2020 as compared to FTEs on February 15, 2020 and then later restores the FTE level back to the February 15 level by June 30, 2020.

Note that for any borrower receiving PPP loan funding on or after the date the application was issued, the June 30 date is going to be before the date that the applicable covered period ends. The application was released less than 8 weeks before June 30, 2020.

The instructions provide:

A safe harbor under applicable law and regulation exempts certain borrowers from the loan forgiveness reduction based on FTE employee levels. Specifically, the Borrower is exempt from the reduction in loan forgiveness based on FTE employees described above if both of the following conditions are met: (1) the Borrower reduced its FTE employee levels in the period beginning February 15, 2020, and ending April 26, 2020; and (2) the Borrower then restored its FTE employee levels by not later than June 30, 2020 to its FTE employee levels in the Borrower’s pay period that included February 15, 2020.

If this is case, the instructions provide the following steps to determine if the safe harbor applies:

Step 1. Enter the borrower’s total average FTE between February 15, 2020 and April 26, 2020. Follow the same method that was used to calculate Average FTE in the PPP Schedule A Worksheet Tables. Sum across all employees and enter: ______________.

Step 2. Enter the borrower’s total FTE in the Borrower’s pay period inclusive of February 15, 2020. Follow the same method that was used in step 1: ______________.

Step 3. If the entry for step 2 is greater than step 1, proceed to step 4. Otherwise, the FTE Reduction Safe Harbor is not applicable and the Borrower must complete line 13 of PPP Schedule A by dividing line 12 by line 11 of that schedule.

Step 4. Enter the borrower’s total FTE as of June 30, 2020: ______________.

Step 5. If the entry for step 4 is greater than or equal to step 2, enter 1.0 on line 13 of PPP Schedule A; the FTE Reduction Safe Harbor has been satisfied. Otherwise, the FTE Reduction Safe Harbor does not apply and the Borrower must complete line 13 of PPP Schedule A by dividing line 12 by line 11 of that schedule.

The borrower must note that while the reduction calculation is based on the 8 week period as compared to the reference period, the test to determine if an exception applies due to restoring employees to a FTE level uses different time periods that do not correspond to any of the periods used in the reduction calculation.

As well, this is an “all or nothing” rule—if the employer falls short of fully restoring the FTE number to the February 15 level, even if by 0.1 FTE, then the entire reduction stays in place. Similarly, if the employer reduced employees compared to the reference period but not compared to February 15, 2020 (such as if there was a staff reduction in early February), then no relief is possible under this rule.

Documentation to Be Provided for Forgiveness

The instructions to the application for forgiveness provides the following documentation should be submitted.

For payroll the instructions request the following documentation:

Documentation verifying the eligible cash compensation and non-cash benefit payments from the Covered Period or the Alternative Payroll Covered Period consisting of each of the following:

a. Bank account statements or third-party payroll service provider reports documenting the amount of cash compensation paid to employees.

b. Tax forms (or equivalent third-party payroll service provider reports) for the periods that overlap with the Covered Period or the Alternative Payroll Covered Period:

i. Payroll tax filings reported, or that will be reported, to the IRS (typically, Form 941); and

ii. State quarterly business and individual employee wage reporting and unemployment insurance tax filings reported, or that will be reported, to the relevant state.

c. Payment receipts, cancelled checks, or account statements documenting the amount of any employer contributions to employee health insurance and retirement plans that the Borrower included in the forgiveness amount (PPP Schedule A, lines (6) and (7)).

The following documentation is to be submitted regarding the FTE calculations:

Documentation showing (at the election of the Borrower):

a. the average number of FTE employees on payroll per month employed by the Borrower between February 15, 2019 and June 30, 2019;

b. the average number of FTE employees on payroll per month employed by the Borrower between January 1, 2020 and February 29, 2020; or

c. in the case of a seasonal employer, the average number of FTE employees on payroll per month employed by the Borrower between February 15, 2019 and June 30, 2019; between January 1, 2020 and February 29, 2020; or any consecutive twelve-week period between May 1, 2019 and September 15, 2019.

The selected time period must be the same time period selected for purposes of completing PPP Schedule A, line 11. Documents may include payroll tax filings reported, or that will be reported, to the IRS (typically, Form 941) and state quarterly business and individual employee wage reporting and unemployment insurance tax filings reported, or that will be reported, to the relevant state. Documents submitted may cover periods longer than the specific time period.

Finally, the following documentation must be provided related to non-payroll costs used in the calculation of the amount of the loan forgiven:

Documentation verifying existence of the obligations/services prior to February 15, 2020 and eligible payments from the Covered Period.

a. Business mortgage interest payments: Copy of lender amortization schedule and receipts or cancelled checks verifying eligible payments from the Covered Period; or lender account statements from February 2020 and the months of the Covered Period through one month after the end of the Covered Period verifying interest amounts and eligible payments.

b. Business rent or lease payments: Copy of current lease agreement and receipts or cancelled checks verifying eligible payments from the Covered Period; or lessor account statements from February 2020 and from the Covered Period through one month after the end of the Covered Period verifying eligible payments.

c. Business utility payments: Copy of invoices from February 2020 and those paid during the Covered Period and receipts, cancelled checks, or account statements verifying those eligible payments.

The instructions provide that while the following items do not need to be submitted with the application for forgiveness, the borrower must maintain the following documentation which the SBA may request be produced:

PPP Schedule A Worksheet or its equivalent and the following:

a. Documentation supporting the listing of each individual employee in PPP Schedule A Worksheet Table 1, including the “Salary/Hourly Wage Reduction” calculation, if necessary.

b. Documentation supporting the listing of each individual employee in PPP Schedule A Worksheet Table 2; specifically, that each listed employee received during any single pay period in 2019 compensation at an annualized rate of more than $100,000.

c. Documentation regarding any employee job offers and refusals, firings for cause, voluntary resignations, and written requests by any employee for reductions in work schedule.

d. Documentation supporting the PPP Schedule A Worksheet “FTE Reduction Safe Harbor.”

All records relating to the Borrower’s PPP loan, including documentation submitted with its PPP loan application, documentation supporting the Borrower’s certifications as to the necessity of the loan request and its eligibility for a PPP loan, documentation necessary to support the Borrower’s loan forgiveness application, and documentation demonstrating the Borrower’s material compliance with PPP requirements. The Borrower must retain all such documentation in its files for six years after the date the loan is forgiven or repaid in full, and permit authorized representatives of SBA, including representatives of its Office of Inspector General, to access such files upon request.

One item that may be of interest is that the documentation of an employee’s refusal to accept work is not being furnished to the bank or, by extension, the Small Business Administration. Thus, it will apparently be up to state unemployment authorities to investigate any situation that they believe may exist where an individual receiving unemployment compensation refused an offer of work.

Of course, since the documentation exists, if the agencies were to investigate this issue, the employer could likely be forced to produce that information.

Are We Finished?

Advisers should be aware that it is very possible the SBA will issue additional guidance on this forgiveness calculation, perhaps via an SBA FAQ (either as an addition to the current SBA FAQ or perhaps a brand-new forgiveness only one) or through the issuance of interim final regulations by the SBA for the area.

[1] “Paycheck Protection Program Loan Forgiveness Application,” Small Business Administration, May 15, 2020, https://content.sba.gov/sites/default/files/2020-05/3245-0407%20SBA%20Form%203508%20PPP%20Forgiveness%20Application.pdf (retrieved May 15, 2020)