AICPA Sends Letter to IRS Recommending PPP Loan Treatment on Various Passthrough Entity Return Issues

The AICPA has sent a letter of comment to the Internal Revenue Service regarding various issues related to basis and entity level accounts for partnerships and S corporations that have or will be receiving forgiveness on Paycheck Protection Program loans.[1]

PPP Loan Issues Following COVID-related Tax Relief Act of 2020

The COVID-related Tax Relief Act of 2020 Section 276 provided clarification that in addition to the forgiveness of a Paycheck Protection Program loan being treated as exempt from federal income tax, any deductions paid with such funds that led to the forgiveness would also be deductible.

While the provision did provide that the forgiveness would lead to an increase in basis for the holder of interests in passthrough entities, the law did not deal with issues related to timing or the potential at-risk issues for the PPP loan, nor specify how the forgiveness and expenses impacted the accumulated adjustments account for an S corporation. These matters can lead to a number of issues that taxpayers and their advisers will need to resolve.

Delayed Deduction of Expenses Paid with PPP Loan Proceeds

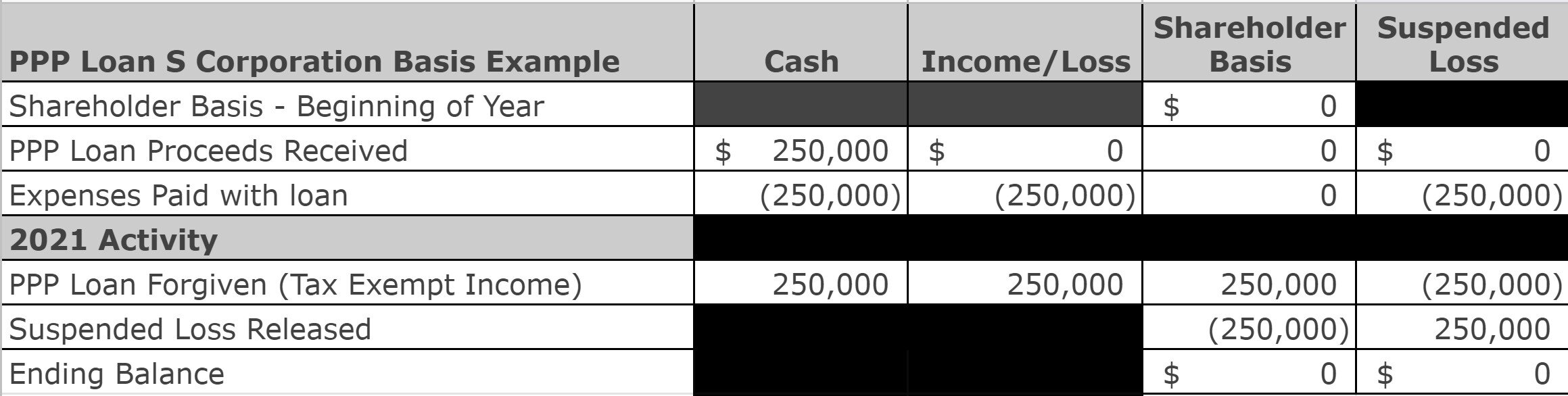

In an S corporation context, the problem is basis for the shareholder. Debt of the S corporation does not result in basis for a shareholder, as there is nothing like the partnership-related IRC §752 for S corporation equity holders. Thus, the S corporation shareholder only receives basis for the PPP proceeds when forgiveness is recognized.

However, the expenses paid with the PPP loan proceeds do reduce basis. So if we have a 100% shareholder that entered the year with no basis in his/her interest, the corporation receives a $250,000 PPP loan in 2020 and spends those funds in 2020, but does not recognize forgiveness until 2021, there can be a problem. If we assume the S corporation broke even except for the expenses paid with the PPP loan it becomes clear that there is going to be a one year delay in recognizing the deduction paid with PPP funds:

The shareholder has no basis at the end of 2020, so cannot deduct the $250,000 loss. Rather, the shareholder must wait until the tax exempt income is recognized by the S corporation in 2021 for his/her basis to be increased under IRC §1367 for the tax-exempt income in order to be able to claim the loss from the expenses paid with those funds.

In a partnership the debt does create basis for the partners (see the above mentioned IRC §752 which increases the basis of a partner’s interest by his/her allocable share of partnership debt). But now the at-risk rules of §465 come into play until the PPP loan is forgiven. Under the term of the PPP loan program, the partners are not personally liable for any of the debts, making the PPP loan an amount not at risk under IRC §465. And, again, losses are limited to the amounts at risk, creating pretty much an identical situation as with the S corporation shareholder, aside from the losses being suspended due to lack of amounts at risk rather than due to lack of basis.

The problem can also surface in a different way—if the shareholder or partner takes distributions in the PPP loan year, the distribution could be taxable due to lack of basis in S corporation stock or a reduction in the amount at risk for the partner.

Accumulated Adjustments Accounts and PPP Loan Forgiveness

S corporations face another problem with PPP loans—the impact on the accumulated adjustments account (AAA) which serves as the limit on S corporation distributions before the distributions are deemed to come out of any earnings and profits the corporation may have.

While a corporation that has always been an S corporation and never entered into any merger or similar transaction with a C corporation that resulted in the S corporation inheriting earnings and profits will not have earnings and profits while it remains an S corporation, that doesn’t mean this isn’t an issue. If that corporation terminates or revokes its S status, the balance in AAA determines how much can be distributed in the post termination transition period tax free.

Again, let’s look at a simplified example. In this case the corporation entered 2020 with AAA of $100,000 and accumulated earnings and profits of $100,000. The corporation obtained a PPP loan in 2020 and obtained forgiveness the same year, spending the funds on expenses on which a deduction is claimed. The corporation makes no distributions in 2020, but does distribute $100,000 in 2021. In both years the company has $0 of income (counting the debt forgiveness and expenses paid) with no separately stated items of income or other sources of non-taxable income.

Tax exempt income does not add to an S corporation’s accumulated adjustments account (IRC §1368(e)(1)). Taking that into account and simply mechanically filling in the Form 1120S as you normally do, you are likely to end up with this situation—and a $100,000 dividend in 2021:

However, you may recall that in Notice 2020-32 the IRS found that expenses related to PPP loan forgiveness represented expenses related to tax-exempt income, resulting in a denial of a deduction under IRC §265(a)(1), a position they reiterated in November of 2020 in Revenue Ruling 2020-27.

While Congress reversed that result, they did not do so by stating these expenses were not related to tax-exempt income, rather just providing that they would be deductible. So, it can be argued, they would remain expenses related to tax-exempt income.

And now IRC §1368(e)(1)(A), which defines AAA, would seem to indicate that these expenses related to tax-exempt income would also not impact AAA:

(1) Accumulated adjustments account

(A) In general

Except as otherwise provided in this paragraph, the term “accumulated adjustments account” means an account of the S corporation which is adjusted for the S period in a manner similar to the adjustments under section 1367 (except that no adjustment shall be made for income (and related expenses) which is exempt from tax under this title and the phrase “(but not below zero)” shall be disregarded in section 1367(a)(2)) and no adjustment shall be made for Federal taxes attributable to any taxable year in which the corporation was a C corporation.

If you follow this treatment, the above example’s result changes, eliminating the taxable dividend:

But many advisers seem nervous about taking this position. First, to get this result on the Form 1120S, the adviser will find that he/she must enter an addition to AAA to offset the expenses found in the non-separately stated income/loss that flows directly onto Schedule M-2 of Form 1120S based on the instructions on the face of the form.

Second, advisers get worried about how to handle the above if the forgiveness was not recognized before the end of the year. While Revenue Ruling 2020-27’s analysis would seem to argue that the expectation of forgiveness is enough to link the expenses to the exempt income, doing so will result in a decrease showing in the other adjustments account with no offsetting increase. While absolutely nothing in the Internal Revenue Code ever refers to this “OAA” account (it’s an invention of IRS form writers basically) and it’s never actually used in determining any tax consequence, advisers feel uncomfortable with this potentially negative OAA showing up on the return.

Finally, there is the reference to decreases in AAA found in Reg. §1.1368-2(a)(3)(i) which reduces AAA by any non-separately stated loss computed under IRC §1368(a)(1)(B). While, in these facts, the effect of that regulation would appear to be at odds with the unambiguous language found in IRC §1368(e)(1)(A) cited above (the Code makes no distinction between deductible and non-deductible expenses related to tax exempt income), it would be taking a position that is contrary to a published, even if arguably likely invalid in this context, regulation. And, of course, a position contrary to a regulation will generally require filing Form 8275-R with the tax return.

Timing of Cancellation of Debt

Finally there’s the issue of determining when forgiveness takes place for the PPP loan. Some may believe that the taxpayer must wait for formal forgiveness to release the tax-exempt income, while others look to the guidance on debt cancellation under IRC §61(a)(11), looking to the case of Cozzi v. Commissioner, 88 TC 435 (1987). Obviously, the earlier the debt is deemed to be forgiven under the tax law, the earlier any basis problem goes away.

AICPA Letter

The AICPA makes three different requests of the IRS in the letter, asking for statements from the agency:

Treating the debt as forgiven as the expenses are paid, and treating the application for forgiveness as merely a ministerial act;

The expenses paid with PPP loan proceeds to be used for debt forgiveness do not reduce AAA for the S corporation; and

The PPP loan is not treated as a debt when answering the questions on the Forms 1065 and 1120S that ask if the taxpayer has had any forgiveness of indebtedness.[2]

Timing for Inclusion in Income of PPP Forgiveness

The AICPA specifically recommends the following on the issue of when a PPP loan should be deemed forgiven and the tax-exempt income be recognized:

The AICPA recommends that Treasury and the IRS issue guidance stating that the proper period under the Code for the inclusion of the tax-exempt income due to Section 276 is when the PPP borrower pays or incurs qualifying expenses during the covered forgiveness period. Additionally, the guidance should state an intention of Treasury and the IRS not to challenge treating the loan forgiveness as a ministerial act. The timing of applying for or receiving approval for PPP loan forgiveness is not relevant for this matching determination regardless of whether a taxpayer is a cash basis or accrual basis taxpayer.[3]

The AICPA generally defends this recommended position as follows:

Taking into account tax-exempt income at the time the PPP funds are expended on qualifying expenses during the covered period provides better matching of income and expenditures for the vast majority of PPP borrowers. The terms and conditions of the PPP are defined by Congress and the SBA and the PPP borrower’s obligations to obtain loan forgiveness are clear. Thus, submission of the PPP loan forgiveness application for many borrowers will be a ministerial process.[4]

The AICPA concedes that this “ministerial process” view may be more troublesome for borrowers with loans of more than $2 million. But the letter concludes that taking this position for all borrowers would still be best:

The determination of loan forgiveness is less clear in the case of a PPP borrower that, together with its affiliates, has a $2 million or more PPP loan. These borrowers are subject to additional scrutiny before the SBA grants loan forgiveness. This additional scrutiny consists of a Loan Necessity Questionnaire whereby the SBA gathers information to assist it in making a determination of eligibility and that the PPP loan was necessary to support ongoing operations of the borrower, a required certification that every PPP borrower made.

Significant taxpayer concern and uncertainty exists that this Loan Necessity Questionnaire and SBA review may be considered a condition precedent to a borrower's loan forgiveness, in essence, precluding the statutory intent. The SBA appears to be conducting a substantive review of eligibility and necessity of the PPP loan by reviewing certain items including a borrower's cash balances, capital expenditures, distributions in excess of tax distributions for passthrough entities, whether the borrower prepaid any outstanding debt, and the borrower's book value prior to obtaining the PPP loan. To date, the SBA has not provided any guidance or insight as to how it uses the information to make a loan forgiveness determination.

Notwithstanding, the SBA has forgiven over 99% of all loan forgiveness applications to date, with a 99.7% forgiveness rate for loans over $1 million. In addition, a PPP borrower that is applying for a second draw loan and has its first draw PPP loan under review by the SBA may be considered an “unresolved borrower” by the SBA. In its guidance, the SBA states that the unresolved borrowers will not receive a second draw loan until the borrower's issues are resolved. However, the SBA also states that many flags in the SBA system will be resolved to the benefit of the borrower.[5]

As well, the AICPA letter argues that Notice 2020-32 and Revenue Ruling 2020-27 support this view that the PPP loan forgiveness application is just such a ministerial act:

The IRS’s guidance in Notice 2020-32 implied that loan forgiveness is ministerial if the borrower has complied with the stated terms and conditions of the PPP. Notice 2020-32 did not distinguish a PPP borrower by its loan size. The filing of the PPP loan forgiveness application did not matter with respect to the “reasonable expectation” determination of Notice 2020-32. Instead, all PPP borrowers were denied deductions of expenses paid with PPP funds, even if the PPP loan was forgiven in a year subsequent to the year qualified expenses were paid or incurred. While this guidance predates the release of the SBA Loan Necessity Questionnaires, Rev. Rul. 2020-27 does not. The loan necessity questionnaires were published in the Federal Register on October 26, 2020 and Rev. Rul. 2020-27 was issued on November 18, 2020. Accordingly, it could be inferred that the IRS determined the loan forgiveness process to be ministerial for all PPP borrowers.[6]

Expenses Related to PPP Loan Forgiveness and AAA/OAA Treatment

The AICPA makes the following recommendation regarding these “related expenses” and their treatment for purposes of the S corporation’s AAA:

The AICPA recommends that the “related expenses” (qualified PPP expenses) that are deducted and attributed to the PPP loan are not taken into account for AAA pursuant to section 1368(e)(1)(A). The OAA should include those related expenses as they directly relate to the tax-exempt income by operation of Section 276 due to PPP loan forgiveness. Treasury and the IRS should issue guidance reflecting this proper treatment and disregard Treas. Reg. § 1.1368-2(a)(3)(i) for this limited purpose.[7]

The AICPA provides the following justification for this position:

The primary policy goal of subchapter S is to treat S corporations as a passthrough entity and ensure a single level of tax for S corporation shareholders. Section 276 explicitly provided for the deductibility of qualified PPP expenses, that PPP borrowers are not to reduce any tax attributes, and that no basis increase shall be denied by reason of the exclusion of PPP forgiveness from gross income. Section 276 intended to accomplish this statutory scheme by treating the PPP loan forgiveness as tax-exempt income for passthrough entities.

To effectuate the statutory intent of Section 276, the OAA should reflect the “related expenses” (i.e., the deductible PPP expenses) as provided for under section 1368(e)(1)(A). In this particular instance, the clear statutory intent of Section 276 (i.e., not creating a taxable event) and overarching policy goal of subchapter S should supersede Treas. Reg. § 1.1368-2(a)(3)(i), and allow the deductible PPP expenses as reducing OAA, eliminating this unexpected outcome of taxable dividends. The qualified PPP expenses would directly match the tax-exempt income, not affecting the AAA balance, while also appropriately increasing S corporation shareholder stock basis.[8]

Debt Questions on Forms 1065 and 1120S

The AICPA also notes that there are concerns about how to answer the questions on the Forms 1065 and 1120S regarding whether there has been a forgiven debt. The letter notes:

There is uncertainty regarding the proper tax reporting for deducting qualified PPP expenses and subsequent loan forgiveness. For example, there is no clear or uniform method to record forgiven PPP loans on a taxpayer's return, such as how and where they are reported (i.e., on a particular line or schedule). In particular, the basis questions on Form 1065 and Form 1120-S are a concern for many PPP borrowers as this is a new and still quickly evolving program:

2020 Partnership Form 1065, Page 2, Schedule B, Question 6 — “During the tax year, did the partnership have any debt that was canceled, was forgiven, or had the terms modified so as to reduce the principal amount of the debt?”

2020 S Corporation Form 1120-S, Page 3 Schedule B, Questions 12 — “During the tax year, did the corporation have any non-shareholder debt that was canceled, was forgiven, or had the terms modified so as to reduce the principal amount of the debt?”[9]

The letter makes the following recommendation to the IRS on this issue:

The AICPA recommends that Treasury and the IRS issue immediate guidance on the proper reporting and expectation in answering these basis questions for passthrough entities that have, or will have, their PPP loans forgiven. This guidance should provide that PPP loans are not debt for the purpose of these questions.[10]

The letter provides the following justification for this position:

In our self-reporting system, taxpayers and practitioners want to report correctly. There are uncertainties and differences of opinion on the IRS position of what would constitute proper reporting of PPP expenses and loan forgiveness. The question is intended to guide taxpayers as to the proper reporting of debt discharge income under sections 61(a)(11) and 108, neither of which is implicated by PPP loan forgiveness due to the exclusion from gross income.[11]

[1] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021, https://www.journalofaccountancy.com/content/dam/jofa/news/aicpa-ppp-forgiveness-s-corp-partnerships.pdf (retrieved March 17, 2021)

[2] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[3] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[4] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[5] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[6] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[7] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[8] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[9] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[10] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021

[11] “Request for Additional Guidance and Proposed Solutions for the Tax Treatment of Tax-Exempt Income from Forgiven Paycheck Protection Program Loans to Partnerships and S Corporations, AICPA Letter, March 15, 2021