Draft 2019 Form 1120-S Instructions Adds New K-1 Statements for §199A

The draft S corporation instructions have been issued by the IRS for 2019 returns, and the instruction disclose three new statements that may be required to be attached to the Form 1120-S Schedule K-1 for 2019.[1] The these forms, along with a new flowchart, deal with the qualified business income items related to §199A.

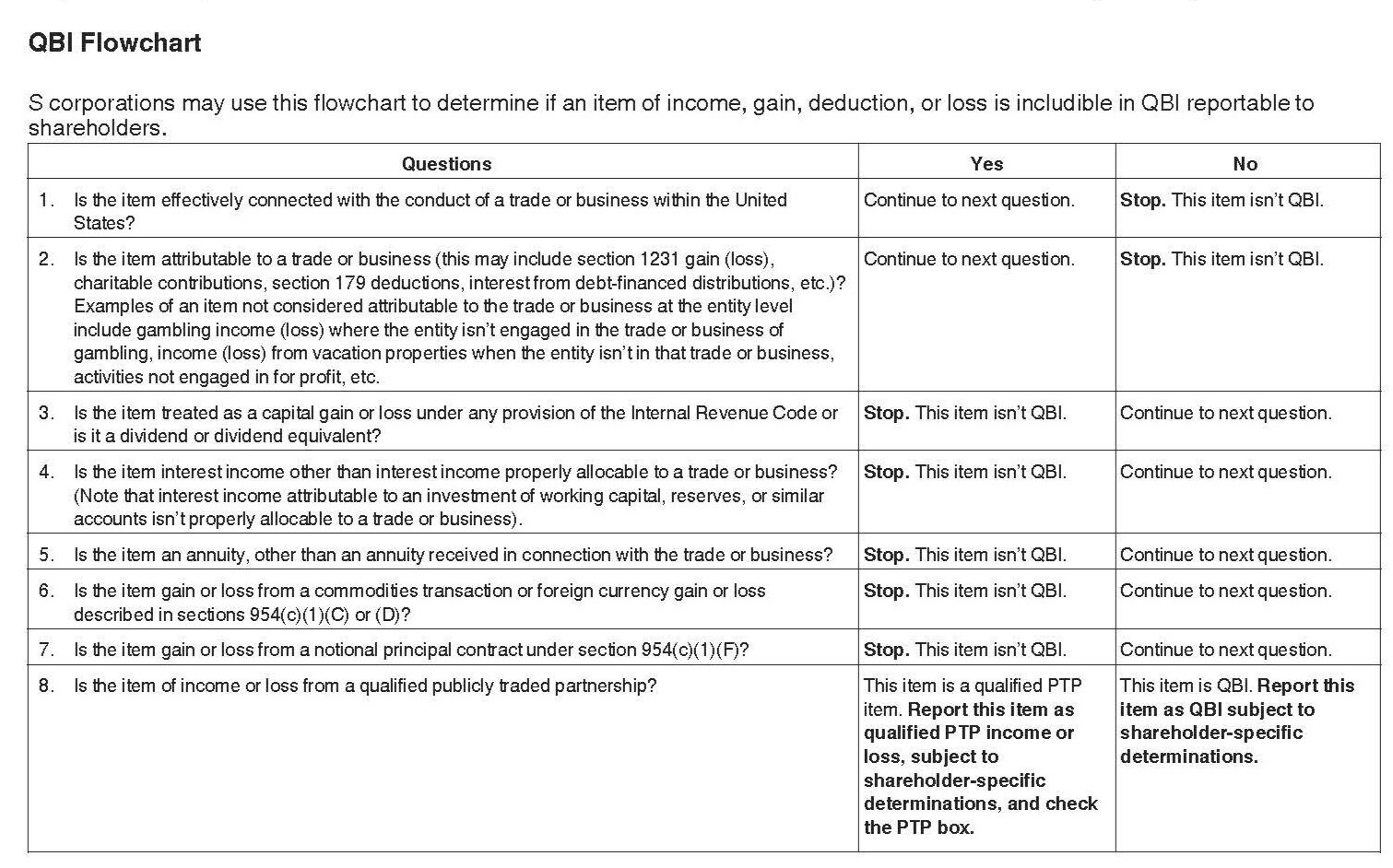

The flowchart, shown below, is meant to assist the preparer in determining the information to report on the K-1 with regard to each trade or business of the taxpayer:

Checklist, 2019 Draft Form 1120-S Instructions

Note that the flowchart again indicates that charitable contributions can reduce QBI, a position the IRS first disclosed in the draft instructions to Form 8995 released earlier in 2019.

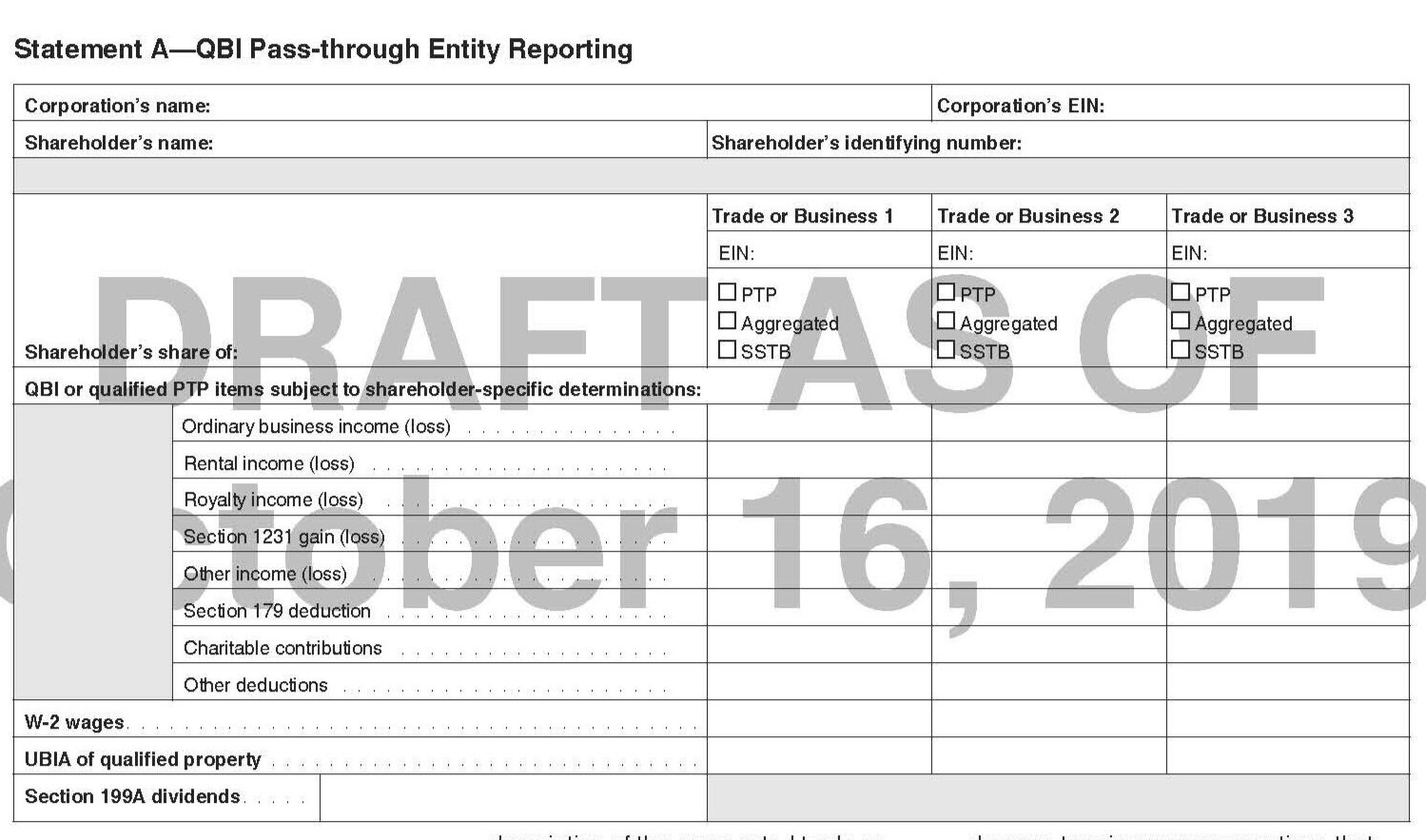

The three statements are to be completed and attached to shareholder’s K-1 to the extent the information on the statement is applicable. Statement A gives information on each trade or business to be reported by the S corporation that will be necessary for the shareholder to prepare his/her return.[2]

Statement A, Draft Form 1120-S Instructions

Note that there is a box to indicate a trade or business is aggregated if the corporation has made that election for eligible businesses. If there is such an aggregation, then Statement B must be attached to the K-1 as well, disclosing information on the aggregation.

Statement B, Draft 2019 From 1120-S Instructions

Finally, if the S corporation has information for patrons of a specified agricultural or horticultural cooperative, then Schedule C must be attached to disclose the information necessary for the deduction under IRC §199A(g).

Statement C, Draft 2019 Form 1120-S Instructions

[1] Draft Instructions for Form 1120-S, October 16, 2019, IRS Website, https://www.irs.gov/pub/irs-dft/i1120s--dft.pdf, retrieved October 19, 2019