IRS Issues Second Draft of Form 1040, Schedule K-1, Asking for Disregarded Entity EIN

A second revision of the draft Schedule K-1, Form 1065 has been released by the IRS for 2019. The changes from the first revision are found in Part II, information about the partner.[1]

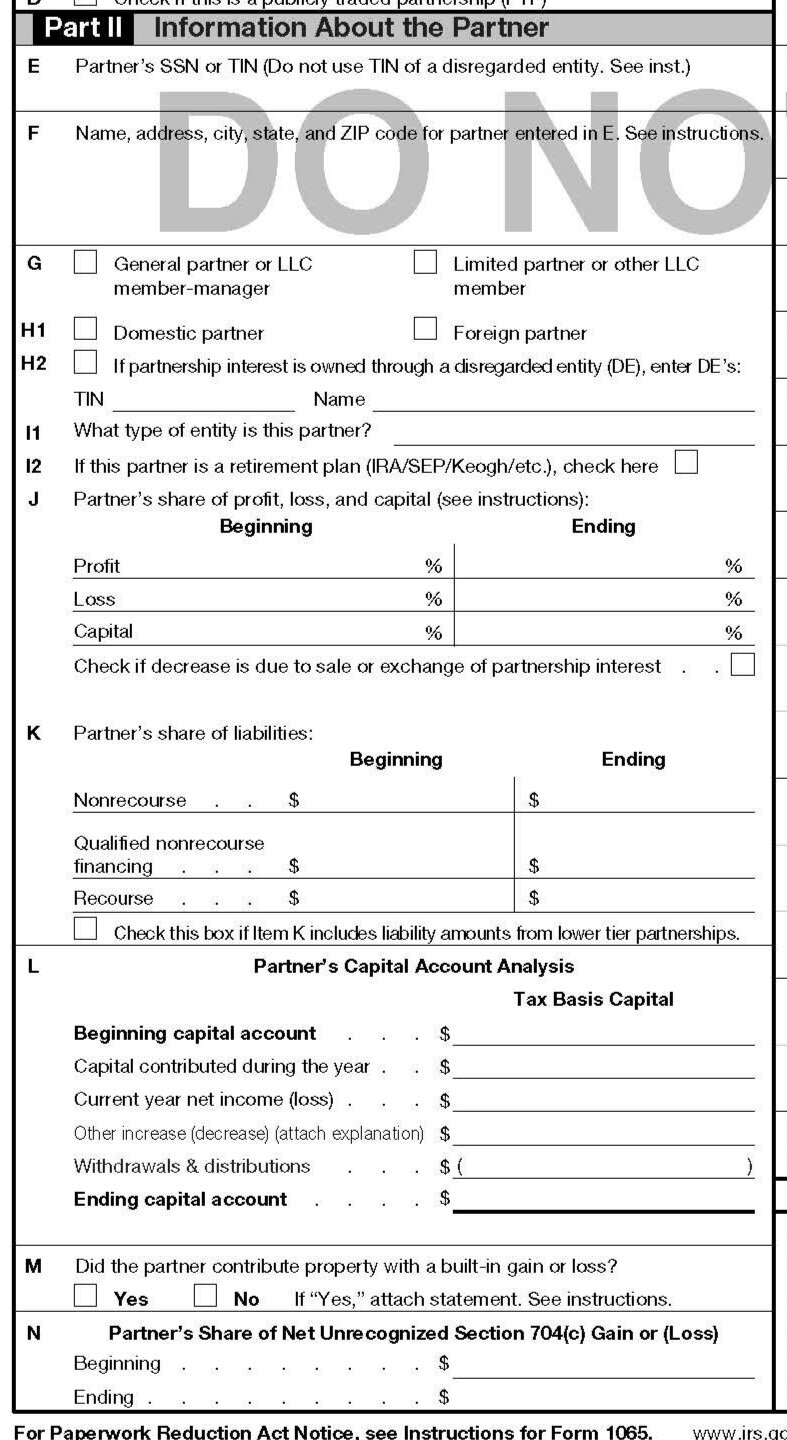

Part II now looks like this:

Revised Part II, 2019 Draft Form 1065 Schedule K-1

The changes begin with less significant changes for lines E & F related to the partner’s identifying number and name and address.

The prior version of the form had the following caption for box E:

Partner’s identifying number (Do not use TIN of disregarded entity. See instructions)

Now box E reads:

Partner’s SSN or TIN (Do not use TIN of a disregarded entity. See inst.)

Box F also contains similarly minor changes, originally reading:

Partner’s name, address, city, state and ZIP code.

Now box F reads:

Name, address, city, state and ZIP code for partner entered in E. See instructions.

While we have to guess at why this change was made, presumably the IRS wants to prevent taxpayers from entering the name of the disregarded entity in the name and address box. The previous caption would have apparently allowed that sort of entry and, quite often this author has seen K-1s titled that way.

Line H has more significant changes, being broken into two lines and now asking for the identification number of any disregarded entity.

[1] Draft 2019 Form 1065, Schedule K-1, October 18, 2019, https://www.irs.gov/pub/irs-dft/f1065sk1--dft.pdf , retrieved October 19, 2019